The German accounting system, known for its precision and thoroughness, is built on a foundation of strict regulations and detailed record-keeping. At its core lies the concept of “Grundsätze ordnungsmäßiger Buchführung” (GoB) or Generally Accepted Accounting Principles.

Detailed Documentation: Every financial transaction must be supported by comprehensive documentation.

German tax laws are renowned for their complexity and stringent enforcement. Understanding these principles is crucial for businesses operating in Germany.

Adhering to German accounting and tax laws is not just a legal obligation but a critical factor for business success in Germany.

By understanding and adhering to German accounting and tax laws, businesses can not only avoid legal troubles but also position themselves for growth and success in the German market. This comprehensive approach to financial management and compliance is essential for building a strong, reputable presence in one of Europe’s most significant economies.

German Accounting Standards, also known as German GAAP (Generally Accepted Accounting Principles) or HGB (Handelsgesetzbuch), form the backbone of financial reporting in Germany. These standards are deeply rooted in the country’s legal and economic traditions, reflecting a strong emphasis on creditor protection and conservative financial reporting.

German GAAP is founded on several key principles that guide financial reporting practices. These principles shape how transactions are recorded, assets and liabilities are valued, and financial statements are prepared.

The Prudence Principle emphasizes a conservative approach to financial reporting, aiming to prevent an overly optimistic presentation of a company’s financial position and performance.

Assets are valued at the lower of cost or market value. If an asset’s market value falls below its historical cost, it must be written down to the lower value. However, if the market value rises above the historical cost, the asset’s value is not increased on the balance sheet.

Liabilities are recorded at their highest potential value. This ensures that all potential obligations are fully reflected in the financial statements, even if there’s a possibility that the actual amount paid might be lower.

Unrealized losses must be recognized immediately, while unrealized gains are not recognized until they are actually realized. This approach can lead to the creation of hidden reserves, as assets may be undervalued and liabilities overvalued compared to their true economic value.

The Realization Principle determines when revenue should be recognized in the financial statements, ensuring that reported income reflects actual economic performance.

Goods

Revenue is typically recognized when the risk of ownership has been transferred to the buyer. In practice, this often means that revenue is recognized upon delivery of goods.

Services

For services, revenue is recognized when the service has been performed. This can lead to differences in revenue recognition patterns between German GAAP and other accounting standards, particularly for long-term service contracts.

Long-term Contracts

German GAAP allows for the use of the percentage-of-completion method under certain circumstances. This method recognizes revenue and profit as work on a contract progresses, rather than waiting until the entire contract is completed. However, its use is subject to strict conditions.

The Imparity Principle requires different treatment for gains and losses, reinforcing the conservative nature of German accounting.

Anticipated Losses

Anticipated losses must be recognized immediately in the financial statements. If a company becomes aware of a potential future loss, it must record this loss in the current period, even if the loss has not yet been realized.

Anticipated Gains

Anticipated gains should not be recognized until they are actually realized. This asymmetrical treatment of gains and losses is a key feature of German GAAP and can lead to significant differences in reported results compared to other accounting standards.

Impact on Reported Profits

The Imparity Principle can have a significant impact on a company’s reported profits, particularly in industries with long-term contracts or significant market volatility. It often results in more conservative profit figures compared to other accounting standards.

The Historical Cost Principle dictates that assets are generally recorded at their original purchase or production cost, rather than their current market value.

Asset Valuation

Assets are recorded at their original purchase or production cost. This provides a reliable and verifiable basis for asset valuation, aiming to prevent manipulation of asset values and ensure consistency in financial reporting.

Revaluation Restrictions

Revaluation of assets to reflect increases in market value is generally not permitted under German GAAP. This contrasts with IFRS and some other accounting standards that allow or require certain assets to be measured at fair value.

Exceptions

There are some exceptions to the Historical Cost Principle, particularly for certain financial instruments. For example, securities held for trading purposes may be valued at market prices. However, these exceptions are limited.

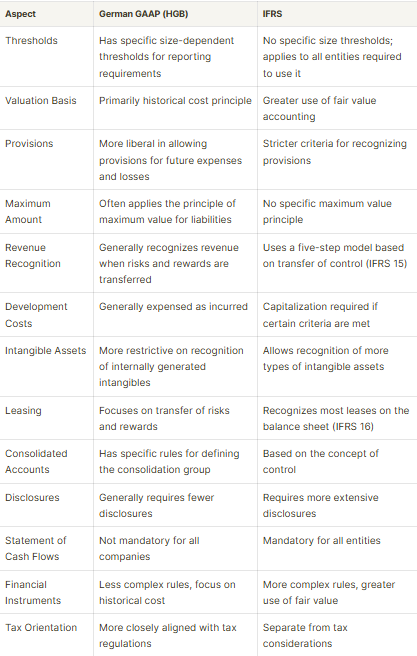

While German GAAP and IFRS share some similarities, there are several key differences reflecting the distinct objectives and historical contexts of the two systems.

Structure

The balance sheet follows a strictly prescribed format as outlined in the HGB. Assets and liabilities are presented in order of liquidity, with the least liquid items appearing first.

Equity Section

The balance sheet includes a detailed equity section, breaking down share capital, various types of reserves, and retained earnings. This detailed presentation reflects the importance placed on capital maintenance in German corporate law.

Deferred Items

A unique feature is the inclusion of a separate section for deferred income (Rechnungsabgrenzungsposten) on both the asset and liability sides, ensuring clear presentation of items like prepaid expenses or unearned revenue.

Presentation Formats

The income statement can be presented in one of two formats: the account form (Kontoform) or the report form (Staffelform). The account form presents expenses on the left and income on the right, while the report form is a vertical presentation.

Expense Classification

Expenses are typically classified by nature rather than function. Categories like personnel expenses, depreciation, and material costs are shown separately, rather than being allocated to cost of sales, administrative expenses, etc.

Extraordinary Items

German GAAP still requires unusual or infrequent items to be shown separately from the results of ordinary activities, unlike IFRS which has eliminated the concept of extraordinary items.

Accounting Policies

The notes must include a description of the accounting policies and methods used in preparing the financial statements. This includes details on valuation methods for assets and liabilities, depreciation methods, and any changes in accounting policies from the previous year.

Detailed Breakdowns

Detailed breakdowns of significant balance sheet and income statement items are provided in the notes. This might include aging schedules for receivables, details of provisions, or breakdowns of revenue by segment or geographic region.

Additional Disclosures

The notes also include additional disclosures required by German law, such as information on employee numbers, management compensation, and related party transactions.

Germany’s tax system is renowned for its complexity and efficiency, reflecting the country’s strong economic foundation and commitment to social welfare. For businesses operating within Germany, a thorough understanding of this system is not just beneficial—it’s essential. This expanded guide delves deeper into the intricacies of German business taxation, offering a more nuanced view of the tax landscape that shapes the German business environment.

Corporate Income Tax forms the backbone of business taxation in Germany, applying uniformly to all corporate entities regardless of their size or industry.

Trade Tax, a distinctive feature of the German tax system, significantly impacts business location decisions within the country.

VAT in Germany aligns with EU directives but includes specific national provisions.

This tax plays a crucial role in Germany’s international tax relations.

The calculation process involves several steps and considerations:

Expanded Example:

Additional Considerations:

The multi-step process reflects the tax’s dual nature as both a federal and local tax:

Expanded Example:

Regional Variations:

The combination of taxes creates a complex landscape for businesses:

This comprehensive overview of the German tax system for businesses provides a solid foundation for understanding the complex tax landscape. However, given the intricate nature of tax laws and their frequent updates, businesses are strongly advised to seek professional tax advice for their specific situations. Stay informed about ongoing developments, as the German tax environment continues to evolve in response to global economic trends and EU directives.

In the complex landscape of German business regulations, proper bookkeeping stands as a cornerstone of financial compliance and operational success. This comprehensive guide delves deep into the intricacies of bookkeeping requirements for businesses operating in Germany, offering a thorough exploration of legal obligations, digital regulations, and strategies to avoid common pitfalls.

The foundation of German bookkeeping requirements is laid out in two primary pieces of legislation:

German law stipulates strict retention periods for various types of business documents:

Important Notes:

To ensure transparency and ease of audit:

Mandatory for:

Single-Entry Bookkeeping:

Businesses must adhere to a strict schedule of financial reporting:

Proper inventory management is crucial for accurate financial reporting:

GoBD (Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff) sets the standards for digital bookkeeping:

To comply with GoBD, electronic bookkeeping systems must:

Electronic invoicing is increasingly important, especially for B2G transactions:

German tax authorities have extensive rights to access digital bookkeeping data:

Businesses must be prepared to provide all three types of access during an audit.

This is a frequent issue, especially for small business owners and freelancers.

Solution:

Falling behind on bookkeeping can lead to errors and compliance issues.

Solution:

Incorrect categorization can lead to tax reporting errors and potential audits.

Solution:

Small expenses can add up and impact financial accuracy if not properly recorded.

Solution:

Data loss can be catastrophic for bookkeeping accuracy and compliance.

Solution:

Failure to reconcile accounts regularly can lead to undetected errors.

Solution:

Mastering the intricacies of German bookkeeping requirements is essential for businesses aiming to thrive in the German market. By adhering to these regulations and implementing robust bookkeeping practices, companies can ensure legal compliance, financial transparency, and operational efficiency.

Our team of expert accountants and bookkeepers specializes in navigating the complexities of German accounting regulations. We offer tailored solutions to help businesses of all sizes maintain impeccable financial records, stay compliant with ever-changing regulations, and make informed financial decisions.

Whether you’re a small startup or a large corporation, our services can be customized to meet your specific needs:

By partnering with us, you can focus on growing your business while we ensure your bookkeeping meets the highest standards of German financial regulations. Contact us today to discover how we can support your business’s financial success in Germany.

Value Added Tax (VAT), known as “Umsatzsteuer” or “Mehrwertsteuer” in German, is a fundamental aspect of the German tax system and a critical consideration for businesses operating in Germany. This comprehensive guide delves into the intricacies of VAT registration, rates, exemptions, reporting requirements, and compliance strategies, providing essential information for businesses navigating the complex landscape of German taxation.

The obligation to register for VAT in Germany is determined by several factors:

The VAT registration process in Germany involves several steps:

To complete the registration process, you’ll need to provide:

Fiscal Representative: Non-EU businesses may be required to appoint a fiscal representative in Germany to handle their VAT obligations.

Understanding the various VAT rates and exemptions is crucial for correct tax calculation and compliance.

Several categories of goods and services are exempt from VAT in Germany:

It’s important to note that while exempt supplies don’t charge VAT, they also generally can’t reclaim input VAT on related expenses.

Temporary VAT Rate Reductions: Germany may occasionally implement temporary rate reductions (as seen during the COVID-19 pandemic in 2020).

Accurate and timely filing of VAT returns is essential for compliance with German tax regulations.

Reporting Periods

The frequency of VAT return filing depends on your annual VAT liability:

Filing Deadlines

Filing Process

Additional Reporting Requirements

Corrections and Amendments

Maintaining VAT compliance in Germany requires diligence and attention to detail. Here are some best practices to consider:

Record Keeping

Accounting Systems

Regular Reviews

VAT Planning

Managing VAT Audits

International Considerations

Navigating the complexities of German VAT can be challenging, especially for businesses new to the German market or dealing with complex transactions. Our team of expert accountants and tax advisors specializes in German VAT compliance and offers a comprehensive range of services to ensure your business meets all VAT obligations efficiently and accurately:

By partnering with us, you can focus on growing your business while we handle the complexities of German VAT compliance. Our deep understanding of German tax law, combined with our commitment to personalized service, ensures that your business stays compliant, minimizes VAT-related risks, and optimizes its tax position in the German market.

Contact us today to learn how we can support your business’s success in Germany and ensure seamless VAT compliance tailored to your specific needs and industry requirements.

Germany, as Europe’s largest economy, presents significant opportunities for businesses. However, navigating its tax system can be complex. This comprehensive guide delves into the intricacies of corporate income tax in Germany, providing essential information for companies operating in or considering entering the German market. We’ll explore tax rates, calculations, deductions, allowances, and filing requirements in detail.

The foundation of corporate taxation in Germany is the standard corporate income tax rate:

A unique feature of the German tax system is the trade tax:

When considering all components, the total tax burden for corporations in Germany is substantial:

To illustrate how these various components come together, let’s consider a practical example:

Assume a company has €1,000,000 in taxable income and is located in a municipality with a 400% multiplier:

This example demonstrates how the various components of the German corporate tax system interact to determine a company’s total tax liability.

Understanding available deductions and allowances is crucial for effective tax planning in Germany. The tax system offers several opportunities for businesses to reduce their taxable income:

Business Expenses

Germany follows the general principle that costs incurred in generating business income are deductible:

Depreciation

The German tax system allows for the depreciation of fixed assets over their useful life:

Loss Carry-Forward

Germany offers favorable rules for carrying forward losses:

Interest Deduction Limitation

To prevent excessive debt financing, Germany implements an interest barrier rule:

R&D Incentives

To promote innovation, Germany offers tax incentives for research and development:

Group Taxation

Germany allows for tax consolidation through its Organschaft system:

Compliance with filing requirements is crucial for businesses operating in Germany. Understanding the process and deadlines helps ensure smooth interactions with tax authorities:

Filing Deadline

Advance Payments

To ensure a steady flow of tax revenue, Germany requires quarterly advance payments:

Electronic Filing

Germany has moved to a fully electronic filing system:

Required Documents

A complete corporate tax return package typically includes:

Audit Risk

The likelihood and frequency of tax audits depend on various factors:

At House of Companies, we specialize in navigating the complexities of German corporate taxation. Our team of expert accountants and tax advisors offers a comprehensive suite of services designed to ensure your business remains compliant while optimizing its tax position in the German market:

By partnering with House of Companies, you gain access to deep expertise in German tax law, ensuring your business makes informed decisions, minimizes tax risks, and maximizes available benefits. Our personalized approach means we take the time to understand your specific business needs and tailor our services accordingly.

Whether you’re a multinational corporation, a growing mid-sized company, or a startup entering the German market, we have the knowledge and experience to guide you through the intricacies of the German corporate tax system.

Contact us today to learn how we can support your company’s success in Germany. Let us handle the complexities of tax compliance and planning, so you can focus on growing your business in one of Europe’s most dynamic markets.

Navigating the intricacies of German payroll accounting, social security contributions, and wage tax calculations is crucial for businesses operating in Germany. This comprehensive guide provides an in-depth look at the latest regulations and requirements for 2024, offering valuable insights for employers, HR professionals, and finance teams.

The German payroll system is governed by a complex network of laws and regulations:

As of 2024, the national minimum wage in Germany is set at €12.41 per hour. Key points to note:

The German social security system is comprehensive and mandatory for most employees. Both employers and employees contribute to various insurance schemes.

As of 2024, the total social security contribution is approximately 40% of an employee’s gross salary, split roughly equally between employer and employee.

Tax Classes

Germany uses a system of six tax classes that affect the amount of wage tax withheld:

Electronic Wage Tax Deduction Features (ELStAM)

Calculation Method

Reporting Requirements

Special Payments and Benefits

To ensure compliance with German payroll regulations:

Navigating the German payroll system requires attention to detail and a thorough understanding of the country’s complex regulations. By staying informed about the latest changes and implementing robust processes, businesses can ensure compliance while optimizing their payroll operations in Germany.

The preparation of annual financial statements is a cornerstone of German business accounting practices. These statements provide a comprehensive overview of a company’s financial health and performance, serving as crucial documents for stakeholders, investors, and regulatory bodies.

The balance sheet, or Bilanz in German, is a fundamental component of financial reporting that offers a snapshot of a company’s financial position at a specific point in time. It is divided into two main sections:

This section details all the resources owned by the company. It includes:

This section outlines the company’s financial obligations and sources of funding:

The Profit and Loss Statement, known as Gewinn- und Verlustrechnung in German, provides a detailed account of a company’s financial performance over a specific period. It includes:

The Profit and Loss Statement, known as Gewinn- und Verlustrechnung in German, provides a detailed account of a company’s financial performance over a specific period. It includes:

The Management Report, or Lagebericht, provides a narrative complement to the financial statements, offering insights into the company’s operations, risks, and future prospects:

The audit process plays a crucial role in ensuring the reliability and accuracy of financial statements in Germany. It provides stakeholders with assurance that the financial information presented complies with relevant accounting standards and gives a true and fair view of the company’s financial position.

Electronic Federal Gazette (Elektronischer Bundesanzeiger)

Disclosure Content

Group Reporting

Penalties for Non-Compliance

Additional Reporting for Listed Companies

By adhering to these comprehensive financial reporting, auditing, and disclosure requirements, German businesses demonstrate their commitment to transparency, accountability, and sound financial management. This rigorous approach not only ensures compliance with legal obligations but also builds trust among stakeholders, including investors, creditors, employees, and business partners.

For companies operating in or expanding into the German market, understanding and implementing these reporting standards is crucial for long-term success and credibility. The complexity of these requirements underscores the importance of working with experienced professionals who can navigate the intricacies of German accounting and reporting practices.

As the regulatory landscape continues to evolve, staying informed about changes in accounting standards, auditing requirements, and disclosure obligations is essential for maintaining compliance and leveraging financial reporting as a strategic tool for business growth and stakeholder communication.

In the intricate landscape of German business operations, understanding and implementing proper accounting practices is crucial for success. This comprehensive guide delves into the world of German accounting services, providing you with in-depth knowledge to make informed decisions for your business.

Bookkeeping forms the foundation of all accounting services. In Germany, this process is known as “Buchhaltung” and involves:

Financial accounting in Germany goes beyond basic bookkeeping and involves more complex financial reporting and analysis:

Payroll processing in Germany is complex due to numerous regulations and frequent changes in labor and tax laws:

Tax advisory services in Germany are typically provided by certified tax advisors (Steuerberater) and encompass:

Management accounting, known as “Controlling” in Germany, focuses on providing financial information for internal decision-making:

Audit services in Germany are primarily provided by certified public accountants (Wirtschaftsprüfer):

Steuerberater are highly qualified professionals who play a crucial role in the German tax and accounting landscape:

Wirtschaftsprüfer represent the highest qualification in the German accounting profession:

Bilanzbuchhalter are specialists in financial accounting and reporting:

Steuerfachangestellter represents an entry-level qualification in the German tax and accounting field:

When choosing an accounting service provider in Germany, consider:

Consider the breadth and depth of services offered:

In today’s digital age, technology plays a crucial role in accounting:

Effective communication is crucial for a successful accounting partnership:

A provider’s track record can give you confidence in their services:

Understanding the cost of services is crucial for budgeting and avoiding surprises:

Given the complex regulatory environment in Germany, consider:

Selecting the right accounting service provider in Germany is a critical decision that can significantly impact your business’s financial health and compliance. By carefully considering these factors and understanding the range of services and qualifications available, you can make an informed choice that aligns with your business goals and operational needs.

Remember, a good accounting partner does more than just manage your books – they can provide valuable insights to drive your business forward, help you navigate the complex German regulatory landscape, and support your company’s growth in the German market and beyond.

In the intricate landscape of German taxation, businesses face the challenge of navigating complex regulations while striving to optimize their tax position. This comprehensive guide delves deep into key strategies for minimizing tax liability, leveraging investment incentives, and addressing international tax considerations for businesses operating in Germany.

The choice of business structure in Germany can significantly impact your tax obligations and overall financial efficiency. Each structure has its own tax implications:

When selecting a structure, consider factors such as liability protection, ease of raising capital, and administrative complexity alongside tax implications.

Effective expense management is crucial for minimizing taxable income:

Structuring employee compensation efficiently can lead to significant tax savings:

Germany offers attractive incentives for companies engaged in R&D activities:

Germany strongly encourages environmentally friendly business practices through tax incentives:

Germany offers various regional incentives to promote economic development in specific areas:

SMEs in Germany benefit from several tax advantages:

Germany incentivizes innovation through various tax measures:

Creating jobs, especially in certain regions or for specific groups, can lead to tax benefits:

Significant investments in business assets can yield tax benefits:

Germany has an extensive network of double taxation agreements (DTAs) with over 90 countries:

Transfer pricing is a critical area for multinational enterprises operating in Germany:

Careful structuring of operations is essential to manage permanent establishment (PE) risks:

Germany’s CFC rules can significantly impact the taxation of foreign subsidiaries:

Value Added Tax (VAT) is a crucial consideration for businesses engaged in cross-border transactions:

By leveraging these tax optimization strategies, businesses operating in Germany can significantly enhance their tax efficiency while ensuring full compliance with German tax laws. It’s crucial to work with experienced tax advisors who understand the nuances of the German tax system and can tailor these strategies to your specific business situation.

Remember that tax laws and incentives are subject to frequent changes, and it’s essential to stay informed about the latest developments in German tax legislation. Regular review and adjustment of your tax strategy will help ensure ongoing optimization and compliance in this dynamic tax environment.

Implementing a comprehensive tax optimization strategy requires a holistic approach, considering not only immediate tax savings but also long-term business goals, regulatory compliance, and reputational factors. By carefully balancing these elements, businesses can achieve sustainable tax efficiency while contributing to their overall success in the German market.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!