Are you ready to streamline the process of preparing your Annual Financial Statements in Germany? With our Entity Management Service, We handle everything from automating your statements to ensuring compliance, so you can focus on growing your business with confidence. Whether you’re looking for real-time financial insights, full bookkeeping support, or expert tax advice, we’re here to make the process smooth and hassle-free. Let us take care of the details—reach out today and simplify your financial reporting in Germany!

€995 . 00

per year

Why spend hours on paperwork when you can let us handle it for you? With our automated financial statements, you save valuable time and effort. Our system ensures your financials are accurate, up-to-date, and compliant with German regulations, so you can focus on growing your business. You no longer have to worry about manual errors or missing deadlines. We take care of it all, giving you more time to focus on what really matters—running your business.

With real-time financial statements, you can access up-to-date information on your company’s financial health at any moment, helping you make smarter, faster decisions.

Our automated system prepares your statements in real-time, so you no longer need to wait for year-end reports everything is available when you need it.

Gain complete control over your finances with real-time data, allowing you to identify trends, address issues early, and plan for the future confidently.

Get the expert support you need with full facilitation from a German bookkeeper. Whether you’re navigating complex financial regulations or just want to ensure your books are in perfect order, we’ve got you covered. Our team works with you every step of the way, handling everything from routine bookkeeping tasks to preparing financial statements. You’ll have peace of mind knowing your finances are in expert hands, so you can focus on what really matters—growing your business.

Let us make managing your finances in Germany easier than ever!

Preparing your German financial statements without hiring an accountant is not only possible but can be a straightforward process when you have the right guidance. This guide is designed to help you navigate the essentials of financial statement preparation, ensuring you maintain compliance and clarity in your reporting.

Gather and Compile Financial Data

The first step in preparing your financial statements is gathering and compiling accurate financial data. This involves collecting information from your income and expense records, invoices, bank statements, and other financial documents. Ensure that your data is organized and easily accessible, as this will lay the groundwork for accurate reporting.

Understand the Types of Financial Statements Required

In Germany, you’ll need to prepare several key financial documents, including:

Balance Sheet: A snapshot of your company’s assets, liabilities, and equity.

Profit and Loss Account (Income Statement): A summary of your revenues and expenses over the fiscal year.

Notes to the Financial Statements: Additional explanations and disclosures to clarify the numbers presented.

For small businesses, these statements may not require an audit, but they must still provide a clear representation of your financial position.

Use Tools to Enhance Data Collection

Utilizing modern accounting software can significantly improve your data collection and management process. These tools help automate the entry and tracking of financial information, allowing you to maintain accurate, real-time records. Look for platforms that offer features such as document scanning and data extraction to streamline your reporting process.

Prepare Financial Statements According to German Standards

When preparing your financial statements, adherence to German accounting standards (HGB – Handelsgesetzbuch) is crucial. Follow these guidelines:

Balance Sheet: Ensure your balance sheet is formatted according to the HGB standards. It should clearly show your assets on one side and liabilities plus equity on the other, balancing the equation.

Profit and Loss Account: This statement should detail all income and expenses for the fiscal year, highlighting both operational performance and net profit or loss.

Cash Flow Statement: If applicable, include a cash flow statement, which outlines cash inflows and outflows from operating, investing, and financing activities.

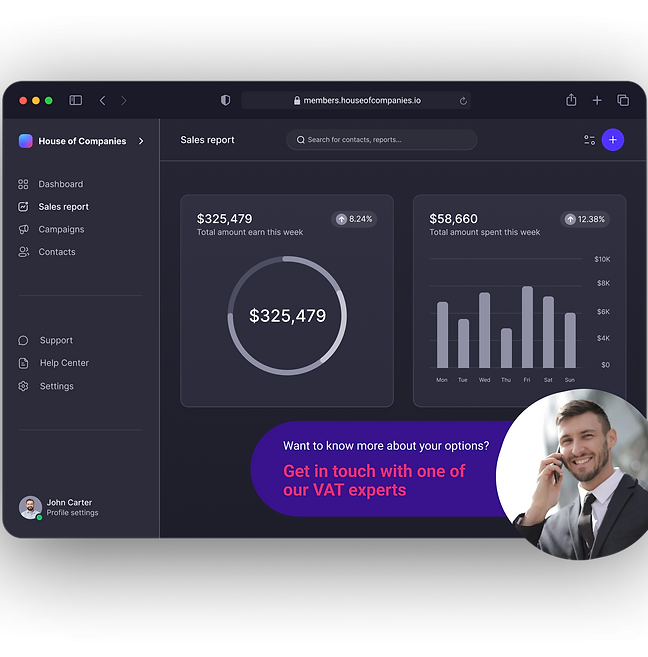

Automate Financial Statements with Our Portal

Consider using our House of Companies portal to automate the generation of your balance sheet and profit and loss account. This platform integrates with your existing systems, making it easy to produce accurate financial statements in real-time, ensuring compliance with German GAAP.

Ensure Compliance with German Accounting Standards

Maintaining compliance with German accounting standards is essential for your financial integrity. Make sure that:

Your financial statements present a true and fair view of your financial position.

All necessary disclosures are included to provide context for your figures.

You stay updated on any changes in accounting regulations that may affect your reporting.

The Importance of Accurate Reporting

Accurate financial reporting is vital not only for compliance but also for maintaining the trust of stakeholders, including investors and partners. Non-compliance can lead to penalties and damage your reputation, so it’s essential to ensure that your statements are both accurate and timely.

Take Control of Your Financial Reporting

By following these steps and leveraging the right tools, you can confidently prepare your German financial statements without the need for an accountant. This not only saves costs but also empowers you to have a deeper understanding of your business’s financial health. If you have any questions or need further assistance, feel free to reach out to us—we’re here to help!

If you ever feel the need for additional expertise, our chartered accountants are here to help. We understand that navigating financial regulations can be challenging, and having a professional on your side can make a difference. With our support, you can get tailored advice and insights specific to your business needs. Rest assured, we’re committed to empowering you with the knowledge and guidance necessary to ensure your financial statements are not just compliant but also optimized for success. Reach out when you need us, and let’s make your financial journey smoother together!

Filing and publishing your financial statements at the Chamber of Commerce (KvK) is an essential step for businesses in Germany. This process ensures that your financial reports are officially recognized and comply with legal requirements. With our Entity Management Service, you can navigate this process with ease.

We take the hassle out of filing. Our team will guide you through the steps, ensuring that your statements are accurate and ready for submission. You can trust us to handle the paperwork, so you can focus on what you do best—running your business.

Don’t let the complexity of regulations overwhelm you. Let us simplify the filing and publishing of your financial statements at the KvK. Together, we’ll ensure that your reports are submitted on time and meet all necessary standards.

You can effortlessly manage your corporate tax analysis and ensure timely submission of your corporate tax returns.

Take Control of Your Tax Situation

We empower you to make informed decisions by providing a comprehensive analysis of your corporate tax obligations. Our team analyzes your financials, identifies potential deductions, and helps you optimize your tax strategy. This proactive approach ensures you’re not just compliant but also maximizing your savings.

Simplified Submission Process

When it’s time to submit your tax returns, we guide you through the entire process. Our experienced professionals will ensure your returns are accurate and submitted on time to the German tax office. You can trust us to handle the paperwork while you focus on running your business.

Stay Informed and Stress-Free

With our service, you’ll never miss a deadline or overlook a critical detail. We keep you updated on any changes in tax regulations, so you’re always in the know. Enjoy peace of mind knowing your corporate taxes are in expert hands.

[1] – https://www.houseofcompanies.io/

[2] – https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/audit/deloitte-nl-audit-annual-accounts-in-the-netherlands-2019.pdf

[3] – https://theaccountingjournal.com/netherlands/financial-reporting-in-the-netherlands/

[4] – https://online.hbs.edu/blog/post/how-to-prepare-an-income-statement

[5] – https://www.youtube.com/watch?v=aRL1MDYFMZ4

[6] – https://www.tax-consultants-international.com/publications/accounting-and-audit-requirements-in-the-netherlands

[7] – https://www.bnnlegal.nl/en/services/insolvency-law-and-bankruptcy/directors-liability-in-the-netherlands/

[8] – https://www.linkedin.com/pulse/7-reasons-conduct-external-audit-uae-atif-iftikhar

[9] – https://www.nba.nl/opleiding/foreign-auditors/ra-qualifications/the-dutch-educational-system-for-register-accountants/

[10] – https://www.kvk.nl/en/filing/when-do-i-have-to-file-my-annual-accounts/

[11] – https://www.kvk.nl/en/filing/am-i-required-to-file-annual-reports-and-accounts/

[12] – https://taxsummaries.pwc.com/netherlands/corporate/tax-administration

[13] – https://business.gov.nl/regulation/corporate-income-tax/

[14] – https://business.gov.nl/finance-and-taxes/business-taxes/filing-tax-returns/filing-your-corporate-tax-return-vpb-in-the-netherlands/

Corporate Tax Analysis involves a detailed review of your business’s financial records to assess your tax obligations, identify deductions, and optimize your tax strategy. Our team ensures that your company is compliant with German tax laws while minimizing your tax burden.

While not mandatory, a chartered accountant can provide valuable expertise, especially for complex tax matters. We offer access to a certified accountant if needed, but our streamlined services are designed to help most businesses manage their tax analysis efficiently.

We gather all the necessary financial data, prepare your corporate tax return, and submit it directly to the German tax office on your behalf. Our experts ensure accuracy and compliance throughout the process, so you don’t have to worry about the details.

You’ll need your financial statements, income reports, and any relevant expense documentation. Our team will guide you through the process and help you organize everything you need for a smooth submission.

Through our corporate tax analysis, we identify potential deductions and credits that can reduce your overall tax liability. We’ll work with you to implement strategies that maximize your tax benefits while ensuring compliance with German tax laws.

Missing the deadline can result in penalties or interest on unpaid taxes. Our service ensures you never miss a deadline by managing the entire submission process for you, keeping you informed and compliant.

Yes, all businesses operating in Germany are required to file corporate tax returns annually. Our service is here to help you meet your obligations without stress.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!