Get Free Demo to our Portal to Manage your Entity or Start a Local Business.

Start your journey in Germany with comprehensive services that handle everything from documentation to legal compliance, saving you time and effort.

Our Entity Management services are designed to streamline the business registration process in Germany, particularly for non-EU entrepreneurs. From preparing documentation to navigating the legal requirements, our experts ensure a hassle-free experience. With Germany as the main focus for your international expansion, we provide tailor-made solutions, whether you’re starting a new venture or expanding an existing business.

Through our services, you gain access to Germany’s robust business environment, benefiting from our global experience, local expertise, and commitment to meeting the unique needs of non-EU businesses. Registering a business in Germany has never been easier with our support in compliance, tax regulations, and business structuring, ensuring a smooth and successful market entry.

We offer comprehensive company registration services in Germany as part of our global Entity Management services. Whether you’re a non-EU entrepreneur or expanding internationally, our team simplifies the process to register a company in Germany, ensuring a smooth and compliant setup.

Our tailored approach ensures you navigate Germany’s legal and regulatory landscape with ease, while we handle the complexities of documentation, legal requirements, and local compliance.

With Germany as a primary focus for non-EU businesses, our service provides end-to-end facilitation for company registration, allowing you to focus on building your business without the administrative burdens.

At our organization, we offer comprehensive Entity Management services for worldwide clients, including businesses from non-EU countries. Our aim is to simplify the company registration process in Germany, ensuring a seamless experience for international entrepreneurs.

Basic Company Structures: In Germany, the most common types of company structures include:

GmbH (Gesellschaft mit beschränkter Haftung): A limited liability company, ideal for small to medium-sized enterprises. It requires a minimum share capital of €25,000.

AG (Aktiengesellschaft): A public limited company suitable for larger businesses, requiring a minimum share capital of €50,000. It allows for shares to be publicly traded.

UG (Unternehmergesellschaft): A simplified version of the GmbH, often referred to as a mini GmbH, which can be formed with as little as €1 in share capital.

Sole Proprietorship: A simple structure for individual entrepreneurs that offers complete control but also personal liability.

Our Overview of Company Registration in Germany service provides essential guidance on the necessary steps, documentation, and compliance requirements. By leveraging our expertise, you can confidently navigate the registration process and set up your business effectively in the German market.

Properly establishing a company is essential for ensuring long-term success and compliance with local regulations. Through our Entity Management services in Germany, we support businesses from non-EU countries in navigating this vital process.

Our expertise in company registration helps you establish a strong foundation, allowing your business to thrive in the German market.

When expanding your business internationally, especially into Germany, selecting the right company structure is crucial for compliance and operational efficiency. Our Entity Management services specialize in helping you navigate the complexities of the German business landscape. We assess your specific needs, industry requirements, and long-term goals to recommend the most suitable entity type, whether it’s a GmbH (limited liability company), AG (public limited company), or any other form.

Understanding the legal and tax implications of various company structures can save you significant time and resources. Our team of experts ensures you are aware of all regulatory obligations and potential benefits associated with each structure. With our support, you can focus on strategic growth, knowing that your company is set up for success within the German market.

Additionally, we provide ongoing assistance to adapt your company structure as your business evolves. Whether you’re entering new markets, adjusting your operations, or experiencing changes in ownership, our services are designed to accommodate your business’s changing needs. With our guidance, you can confidently establish a solid foundation for your international venture.

Our expertise extends to assisting international entrepreneurs in navigating the complexities of local regulations and establishing their presence in various markets.

One of the valuable resources we provide is guidance on How to Register a Business in Germany by Yourself. This service empowers entrepreneurs with the knowledge and tools needed to successfully complete the registration process independently.

Step-by-Step Guide to Self-Registration

We break down the process into manageable steps, covering essential aspects such as choosing the right business structure, obtaining necessary permits, and understanding tax obligations. Our aim is to make the self-registration process in Germany as straightforward and efficient as possible.

When establishing a company in Germany, non-residents should be aware of several important factors. Key requirements include a local registered office, the appointment of a managing director, and compliance with German commercial law. Understanding these foundational elements is essential for a successful business launch.

Non-residents must navigate the German tax system, which includes corporate tax, trade tax, and value-added tax (VAT). It is crucial to establish a tax identification number and ensure timely filings to avoid penalties. Staying informed about tax obligations helps maintain compliance and facilitates smooth operations.

The legal structure of the company is another critical consideration. Options include GmbH (limited liability company) and AG (public limited company), each with distinct regulatory requirements. Choosing the right structure can influence taxation, liability, and administrative responsibilities.

Understanding the employment regulations in Germany is vital for non-residents planning to hire staff. Compliance with labor laws, including employee rights and social security contributions, is essential for maintaining a compliant and successful business environment. Our expert team is ready to guide you through these important considerations, ensuring a smooth establishment of your company in Germany.

One effective way to enter the German market is through branch registration. This option allows foreign companies to operate under their existing business structure while expanding into Germany. Familiarizing yourself with the fundamental regulations and requirements is crucial to ensure a seamless registration experience.

In Germany, a branch operates as an extension of the parent company, meaning it does not constitute a separate legal entity. Nevertheless, it must comply with German legal standards, including tax obligations and employment regulations. Our experienced team is equipped to assist you in navigating these essential requirements, helping you establish your branch effectively and in accordance with German law.

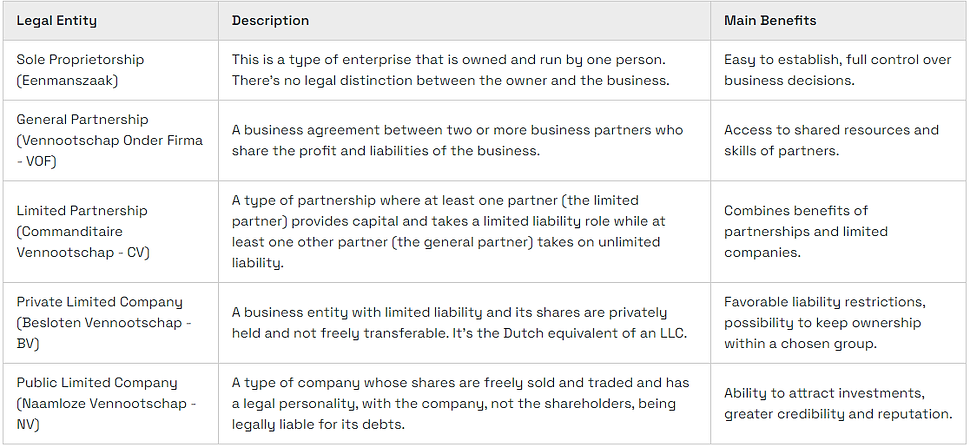

In Germany, various legal entities cater to different business needs, each with unique structures, advantages, and requirements. Understanding these options is essential for non-residents looking to establish a presence in this robust economy.

The GmbH (Gesellschaft mit beschränkter Haftung) is one of the most popular forms of business entities in Germany. This limited liability company requires a minimum share capital of €25,000, making it an attractive choice for small to medium-sized enterprises. The GmbH provides personal liability protection for its shareholders, ensuring their personal assets are separate from the company’s debts.

Another common legal structure is the AG (Aktiengesellschaft), a public limited company ideal for larger enterprises. This entity requires a minimum share capital of €50,000 and allows shares to be publicly traded. The AG structure is well-suited for businesses aiming for significant growth and investment opportunities.

For freelancers and sole proprietors, the Einzelunternehmen (sole proprietorship) offers a straightforward approach. This structure requires minimal registration and is easy to manage, but the owner is personally liable for all business debts.

Additionally, Partnerships (Personengesellschaften) are prevalent in Germany, including the GbR (Gesellschaft bürgerlichen Rechts) and OHG (Offene Handelsgesellschaft). These entities allow two or more individuals to operate a business together, sharing profits and responsibilities.

Choosing the right legal entity is crucial for ensuring compliance with German regulations while aligning with your business objectives. Our team is here to provide expert guidance, helping you navigate these options and establish a successful venture in Germany.

Our Entity Management Services cater to global entrepreneurs, including those from non-EU countries, seeking to establish a presence in Germany. A crucial step in this process is selecting the appropriate legal business structure. In Germany, entrepreneurs can choose from several options, including sole proprietorships, partnerships, and corporations such as the GmbH (limited liability company) and AG (public limited company). Each structure has distinct implications for liability, taxation, and operational flexibility, which are essential to consider based on your business goals.

Selecting the right legal structure is vital for long-term success and compliance in the German market. Our expert team assists entrepreneurs in evaluating their options, taking into account factors like ownership, funding, and administrative requirements. With our support, you can make an informed decision that aligns with your vision, ensuring a strong foundation for your business in Germany and beyond.

Setting up a company in Germany is a streamlined process, particularly attractive to entrepreneurs from EU countries like Germany. The Dutch government has established efficient procedures to facilitate business registration, making it an ideal location for international business ventures. Generally, the entire process can take anywhere from a few days to a couple of weeks, depending on various factors such as the type of business and the required documentation.

The first step in setting up your company is to choose a legal structure. Common options include a private limited company (BV), public limited company (NV), or sole proprietorship. Each structure has its own requirements and implications for liability, taxation, and management. Once you’ve decided on the structure, you’ll need to gather the necessary documentation, such as identification, a business plan, and proof of address. Having these documents in order can significantly speed up the registration process.

Next, you will need to register your company with the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). This process is generally quick and can often be done online. You’ll receive a registration number, which is essential for opening a bank account and fulfilling tax obligations. The KvK can typically process your application within a few business days, allowing you to move forward with your business operations swiftly.

After registering with the KvK, you must also obtain a tax identification number (RSIN) from the Dutch tax authorities (Belastingdienst). This step is essential for your business’s tax obligations. The tax authority usually issues this number shortly after your company registration, allowing you to start trading without unnecessary delays.

Finally, while the process is efficient, it’s important to consider any additional licenses or permits your specific business may require, depending on the industry. These can take extra time to secure, so it’s wise to research these requirements in advance. With the right preparation and understanding of the steps involved, setting up your company in Germany can be a fast and rewarding experience, offering a gateway to the broader European market for German entrepreneurs.

When establishing a business presence in the Netherlands, registering with the Dutch Commercial Register (Handelsregister) is a crucial step. This official register, maintained by the Netherlands Chamber of Commerce (Kamer van Koophandel), records all businesses operating in the Netherlands, ensuring transparency and compliance with Dutch laws.

Importance of Registration

Steps to Register Your Company

Navigating Registration from Germany

For businesses based in Germany looking to expand into the Netherlands, the registration process can be conducted remotely. Our entity management services offer guidance throughout the registration process, ensuring compliance with Dutch regulations and seamless integration into the Dutch market.

Our Support

Our entity management services provide comprehensive support for registering your company with the Dutch Commercial Register. We assist with documentation preparation, application submission, and ongoing compliance to ensure a smooth and efficient process. Whether you’re a local entrepreneur or a foreign business expanding into the Netherlands, we are here to help you for international business registration.

Drafting the Articles of Association (Gesellschaftsvertrag) is a critical step in establishing a business in Germany. This document serves as the foundational legal framework for the company, outlining its purpose, structure, and operational guidelines. The Articles of Association must be tailored to meet the specific needs of the business while adhering to German corporate law requirements. It typically includes information about the company’s name, registered office, business activities, share capital, and governance structure.

One key aspect of the Articles of Association is defining the roles and responsibilities of the shareholders and directors. This section outlines how decisions will be made, voting rights, and the procedure for appointing and dismissing directors. Clear definitions help prevent disputes and ensure that all stakeholders understand their rights and obligations within the company.

Another important component is detailing the share capital and the types of shares issued. In Germany, the minimum share capital varies depending on the type of legal entity. For example, a limited liability company (GmbH) requires a minimum share capital of €25,000, while a public limited company (AG) requires €50,000. The Articles of Association should specify the division of shares and any special rights attached to them, providing transparency for both shareholders and potential investors.

Finally, the Articles of Association must comply with the German Commercial Code (Handelsgesetzbuch) and be notarized before submission to the local commercial register. This notarization process adds a layer of legal validation, ensuring that the document is officially recognized. Our entity management services can assist you in drafting comprehensive Articles of Association tailored to your business needs, ensuring compliance with all legal requirements in Germany.

This process is crucial for ensuring that your company is managed effectively and in compliance with local regulations.

Understanding the Appointment Process

The appointment of directors and shareholders involves several steps, starting with selecting individuals who possess the necessary qualifications and experience. Our team provides guidance on the legal requirements and best practices for appointing directors who will lead your business in Germany.

Documentation and Compliance

To initiate the process, you’ll need to prepare specific documentation, including identity verification for directors and shareholders, proof of residency, and consent forms. We assist you in gathering and submitting these documents to ensure compliance with German corporate law.

Registration and Notification

Once appointments are made, we handle the necessary registration with the commercial register (Handelsregister) and notify relevant authorities. Our expert team ensures that all steps are taken promptly and accurately, minimizing delays in your business operations.

Ongoing Support

After the appointment process is complete, we continue to provide ongoing support to ensure your directors and shareholders fulfill their roles effectively. Our services include regular updates on regulatory changes and assistance with any necessary adjustments to your corporate structure.

By leveraging our Entity Management services, you can navigate the complexities of appointing directors and shareholders in Germany with ease and confidence, allowing you to focus on growing your business worldwide.

Our Entity Management services extend to businesses worldwide, including non-EU countries, offering comprehensive support for setting up essential banking solutions. Opening a business bank account in Germany is a crucial step for any entrepreneur looking to establish a presence in the European market. We guide you through the entire process, ensuring compliance with local regulations while facilitating smooth interactions with financial institutions. Our expertise in German banking landscape means you can focus on growing your business, knowing your banking needs are in capable hands.

We understand that opening a business bank account can be daunting, especially for international clients. That’s why our dedicated team is here to simplify the process. We assist you with the required documentation, help you select the right bank that suits your business needs, and provide ongoing support to ensure your banking operations run efficiently. With our Entity Management services, you gain access to the resources and expertise necessary to establish a strong financial foundation in Germany, setting your business up for success in the competitive global marketplace.

Here’s a step-by-step guide to help you understand how to register a firm in Germany:

Step 1: Choose a Business Name

Ensure that your chosen business name complies with German regulations and is unique.

Step 2: Determine Your Business Structure

Decide on the type of legal entity (e.g., GmbH, AG) and define roles for shareholders and directors.

Step 3: Draft the Articles of Association

Create the formal documents outlining your company’s objectives and operational procedures. These documents must be notarized.

Step 4: Register with the Commercial Register

Submit your notarized Articles of Association to the local Commercial Register (Handelsregister) for registration.

Step 5: Obtain Tax Identification Numbers

After registration, apply for your tax identification number (Steuernummer) from the local tax office (Finanzamt).

Step 6: Open a Business Bank Account

Set up a corporate bank account using your registration documents and proof of identity.

Step 7: Set Up Accounting Systems

Implement an accounting system to ensure compliance with German financial regulations and ease tax reporting.

So, what are the costs associated with setting up a business in Germany? The fees for registration can vary depending on whether you’re establishing a branch or forming a German limited liability company (Gesellschaft mit beschränkter Haftung, or GmbH).

Firstly, if you’re registering a branch, the costs typically include a registration fee of around €50 to €150 at the local trade office (Gewerbeamt). This fee is applicable to all business types, including branches, partnerships, and sole proprietorships. Additional expenses may arise if you seek professional legal assistance or require translation services during the process.

On the other hand, if you’re forming a GmbH, the costs will be higher due to the need for notarization of the articles of association. Notary fees can range from €500 to €1,200, depending on the notary and complexity of your business structure. Additionally, you will need to have a minimum share capital of €25,000, of which half must be deposited before registration.

Beyond notary and registration fees, you may also encounter costs for legal advice, drafting contracts, and potential translation services.

Keep in mind that these are just the initial costs. Other ongoing expenses to consider include annual accounting fees, tax management, and general operational costs. It’s crucial to thoroughly assess your specific situation to avoid any unexpected expenses and ensure a successful business setup.

The Germany Business Register, known as the Handelsregister, is where all businesses must be officially registered. You will need to submit a completed registration form, your valid identification, and proof of your business’s address. After submitting the necessary documents and paying a one-time registration fee, you will receive a unique Handelsregister number, which is required for all formal business activities.

Registering with the Germany Tax Administration

In addition to registering with the Handelsregister, you must also register with the Germany Tax Administration (Finanzamt). Upon registration with the Handelsregister, your details are automatically shared with the Finanzamt. You will receive a tax identification number and a VAT number if applicable, which are essential for managing your tax obligations in Germany.

Key Points During Registration

Expect to receive a tax identification number and VAT number from the Finanzamt.

Once registration is complete, you can officially begin your business operations in Germany, following the appropriate legal and tax frameworks.

The German Tax System offers several advantages for businesses, including a network of tax treaties with many countries, making cross-border operations more tax-efficient. Additionally, Germany provides a range of tax incentives for research and development (R&D), making it an attractive destination for innovation-driven businesses.

German tax law also allows deductions and special allowances, especially in relation to investment activities and R&D projects. This ensures that businesses can optimize their tax liabilities while investing in growth and development.

Corporate Income Tax (CIT)

In Germany, companies are subject to Corporate Income Tax (CIT) on their worldwide income if they are resident entities. Non-resident companies, however, are taxed only on the income earned from German sources. The current CIT rate stands at 15%, with an additional solidarity surcharge of 5.5% on the CIT, bringing the total to approximately 15.825%.

Trade Tax

Trade tax (Gewerbesteuer) is a municipal tax applied to business income. The rate varies by municipality and typically ranges between 7% and 17%. Trade tax is deductible from the corporate income tax base, which can reduce the overall tax burden.

Value Added Tax (VAT)

VAT in Germany applies to the sale of goods and services, with a standard rate of 19%. A reduced rate of 7% applies to certain goods and services, such as food and printed materials. Certain international transactions are exempt from VAT, or a 0% rate may apply.

Dividend Tax

Dividends paid by German companies are subject to a 25% withholding tax, but this rate can be reduced under Germany’s extensive network of tax treaties or even eliminated under the EU Parent-Subsidiary Directive. This system is designed to avoid double taxation and promote investment within the EU.

Payroll Taxes

Employers in Germany must withhold wage tax (Lohnsteuer) and social security contributions from employees’ wages. Wage tax is an advance payment of income tax and must be remitted to the tax authorities on a regular basis.

Other Taxes

Additional taxes in Germany may include real estate tax, environmental taxes, and local business taxes, depending on the location of the business. Understanding these taxes is essential for compliance and efficient financial management.

Research and Development (R&D) Tax Credit

Germany encourages innovation through its R&D tax credit, which allows companies to claim a portion of their R&D expenses as a tax deduction. This provides substantial savings for businesses investing in technological and scientific advancements.

Investment Grants for New Businesses

Germany offers investment grants for businesses that establish operations in certain regions. These grants can help reduce the cost of starting and expanding businesses, especially in less economically developed areas.

Reduced Corporate Tax Rates for Small and Medium-Sized Enterprises (SMEs)

Germany provides reduced corporate tax rates for SMEs, allowing smaller businesses to benefit from a lower tax burden as they grow. This incentive aims to support entrepreneurship and business expansion.

This includes compliance with the German Commercial Code (HGB) and International Financial Reporting Standards (IFRS), where applicable.

Audit Requirements in Germany

Hiring personnel in Germany is a straightforward process, characterized by a well-structured labor market and a highly skilled workforce. The German labor force is known for its strong work ethic, high educational standards, and proficiency in English, particularly among younger professionals.

Professional Recruitment Agencies

Germany has numerous recruitment agencies specializing in various sectors, providing businesses with access to a diverse talent pool. These agencies are well-versed in the local job market, facilitating efficient recruitment processes for companies seeking skilled personnel.

Labor Market Flexibility

The German labor market is flexible, offering a range of employment contracts, including full-time, part-time, and temporary positions. This flexibility allows companies to tailor their workforce according to operational needs and market demands.

Digital Hiring Platforms

Online job portals, professional networking sites, and social media are widely used in Germany to post job advertisements. Utilizing these platforms helps businesses reach a broad audience, particularly effective for startups and small businesses looking to attract potential employees.

Labor Laws and Regulations

Germany has specific labor laws that govern the hiring process, including regulations on non-discrimination, data protection, and fair employment practices. Companies must comply with these laws to ensure a fair recruitment process. Seeking legal advice or assistance from HR service providers can be beneficial for navigating these regulations.

Wage Structure and Employment Policies

Germany features a regulated minimum wage system that ensures fair compensation for all workers. Companies must be aware that wages in Germany can be relatively high compared to other countries, which affects budgeting and financial planning.

Employee Rights and Obligations

Employers in Germany are obligated to provide certain benefits, such as paid sick leave and parental leave, contributing to a high standard of employee rights. While this protects workers, it can impose additional responsibilities and costs on employers.

Intellectual property (IP) protection in Germany is robust, governed by national laws and European regulations. Businesses can protect their innovations through various IP rights, including patents, trademarks, copyrights, and designs. The German Patent and Trademark Office (DPMA) is responsible for the registration and enforcement of patents and trademarks. To obtain a patent, an invention must be novel, involve an inventive step, and be industrially applicable. Trademarks can be registered for goods and services to protect brand identity and prevent unauthorized use by competitors.

Additionally, Germany is a signatory to international agreements such as the Paris Convention and the TRIPS Agreement, which provides a framework for protecting IP rights across borders. Businesses are encouraged to conduct thorough IP audits to identify and protect their intellectual assets. Seeking legal advice from IP specialists can help ensure compliance with relevant laws and enhance the effectiveness of protection strategies.

Obtaining the necessary permits and licenses is essential for businesses operating in Germany. Depending on the nature of the business, various licenses may be required. For example, companies engaged in regulated sectors such as construction, healthcare, and food services must secure specific permits from relevant authorities. The application process often involves submitting detailed documentation that outlines the business’s activities, compliance with safety standards, and adherence to environmental regulations.

Additionally, businesses may need to register with the local trade office (Gewerbeamt) and obtain a trade license (Gewerbeschein) to legally operate. For certain activities, like importing goods or operating as a financial service provider, additional licenses from federal agencies may be necessary. It’s crucial for entrepreneurs to understand the regulatory framework applicable to their industry and ensure they have all the required permits and licenses to avoid legal complications and penalties. Consulting with legal experts or local business advisors can aid in navigating the licensing landscape effectively.

Establishing a business in Germany presents significant opportunities, thanks to its strong economy, skilled workforce, and strategic location within Europe. However, The regulatory landscape, including permits, licenses, and intellectual property protection, is crucial for success. Understanding the specific requirements of your industry and ensuring compliance with local laws can help mitigate risks and streamline operations.

Entrepreneurs are encouraged to leverage professional services and local expertise to navigate the complexities of the German market effectively. By doing so, businesses can not only protect their interests but also position themselves for sustainable growth and success in a competitive environment. Investing time and resources in thorough planning and compliance will pave the way for a prosperous business journey in Germany.

1. What are the legal requirements for starting a business in Germany?

To start a business in Germany, you must choose a legal structure (e.g., sole proprietorship, GmbH, AG), register your business with the local trade office (Gewerbeamt), and obtain any necessary permits or licenses. Additionally, you may need to register with the tax office (Finanzamt) for tax purposes.

2. Do I need a business plan?

While a business plan is not legally required, it is highly recommended. A well-structured business plan helps outline your business goals, strategies, and financial projections, which can be useful when seeking financing or partnerships.

3. What permits and licenses are required?

The permits and licenses required depend on your business type and industry. Common requirements include a trade license (Gewerbeschein), industry-specific permits (e.g., food handling, healthcare), and, in some cases, environmental permits.

4. How do I register my business in Germany?

To register your business, you need to complete the registration form at the local trade office (Gewerbeamt), pay the registration fee, and provide necessary documents such as identification, business description, and proof of address.

5. What taxes do I need to pay as a business owner?

Business owners in Germany are subject to various taxes, including income tax, corporate tax, trade tax, and value-added tax (VAT). The specific tax obligations depend on your business structure and earnings.

6. Is it easy to hire employees in Germany?

Germany has a skilled and educated workforce, making it relatively easy to hire employees. However, businesses must comply with labor laws regarding contracts, wages, and employee rights.

7. What support is available for startups in Germany?

Germany offers various support programs for startups, including funding options, mentorship programs, incubators, and accelerators. Organizations like the German Startups Association and local chambers of commerce can provide valuable resources and networking opportunities.

8. How do I protect my intellectual property in Germany?

To protect your intellectual property (IP), you can register patents, trademarks, and copyrights with the German Patent and Trademark Office (DPMA). Additionally, consider seeking legal advice to navigate the complexities of IP protection.

9. Can I operate a business in Germany as a foreigner?

Yes, foreigners can establish and operate a business in Germany. However, it may be necessary to obtain a residence permit or visa, depending on your nationality and the nature of your business activities.

10. What are the costs involved in starting a business in Germany?

The costs of starting a business in Germany can vary widely depending on factors such as business type, registration fees, permits, and initial setup costs. It’s essential to conduct a thorough financial analysis to estimate your startup costs accurately.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!