Got questions?

Lets talk about your options

In Germany, corporate support is crucial for businesses, especially foreign entities entering the market. It encompasses a range of services designed to ensure compliance with German corporate law and facilitate smooth operations. From managing regulatory filings to overseeing corporate governance, corporate support provides the backbone for successful business operations in Germany’s complex legal landscape. Whether through traditional means or modern eBranch services, having robust corporate support can significantly impact a company’s ability to navigate the German business environment effectively.

At House of Companies, we specialize in corporate management and offer a range of online services to help you update your corporate structure. Whether you need to appoint Corporate Secretary or Local Support of an Agent, our team is here to assist you with all your secretarial affairs. With our expertise and user-friendly online platform, you can streamline corporate management and focus on growing your business.

Appointing a corporate secretary in Germany, while not legally mandated, is a strategic move for businesses. This role, often referred to as “Prokurist” or “Handlungsbevollmächtigter,” is crucial for maintaining corporate compliance and facilitating smooth operations.

The corporate secretary ensures adherence to German corporate laws, including the Stock Corporation Act (Aktiengesetz) and Limited Liability Companies Act (GmbH-Gesetz). They manage essential tasks such as organizing annual general meetings, maintaining corporate records, and liaising with government authorities.

For foreign businesses, a corporate secretary provides invaluable local expertise, helping navigate Germany’s complex regulatory landscape.

Local support agents in Germany offer invaluable assistance to businesses, particularly foreign entities. While not legally required, having local representation can significantly ease operations. These agents provide crucial services like managing correspondence with German authorities, assisting with tax compliance, and ensuring adherence to local regulations.

They act as a bridge between the company and German bureaucracy, helping navigate complex processes such as business registration and obtaining necessary permits. Local support is particularly beneficial for companies without a physical presence in Germany, as it fulfills the requirement for a local business address and provides a point of contact for official communications.

A German corporate secretary offers a wide array of services essential for maintaining corporate compliance and smooth operations. Key responsibilities include:

Ensuring compliance with German corporate laws and regulations

Managing corporate records and official filings

Organizing and documenting annual general meetings

Liaising with government authorities, including tax offices and commercial registers

Overseeing corporate governance practices

Assisting with contract management and legal compliance

Coordinating with tax advisors for financial compliance

Facilitating communication between the company and its shareholders

These services help businesses navigate Germany’s complex regulatory environment, mitigate legal risks, and focus on core business activities.

The costs for corporate secretary services in Germany vary based on the scope of services and company complexity.

Basic packages typically range from €3,000 to €5,000 annually, covering essential compliance and record-keeping.

More comprehensive services, including legal support and strategic advisory, can cost between €5,000 and €20,000+ per year.

While German law doesn’t strictly require a physical office for all businesses, a registered address is necessary as per Section 8 of the Commercial Code (Handelsgesetzbuch).

This requirement can be fulfilled through various means, from traditional office spaces to virtual office solutions, offering flexibility in establishing a business presence in Germany.

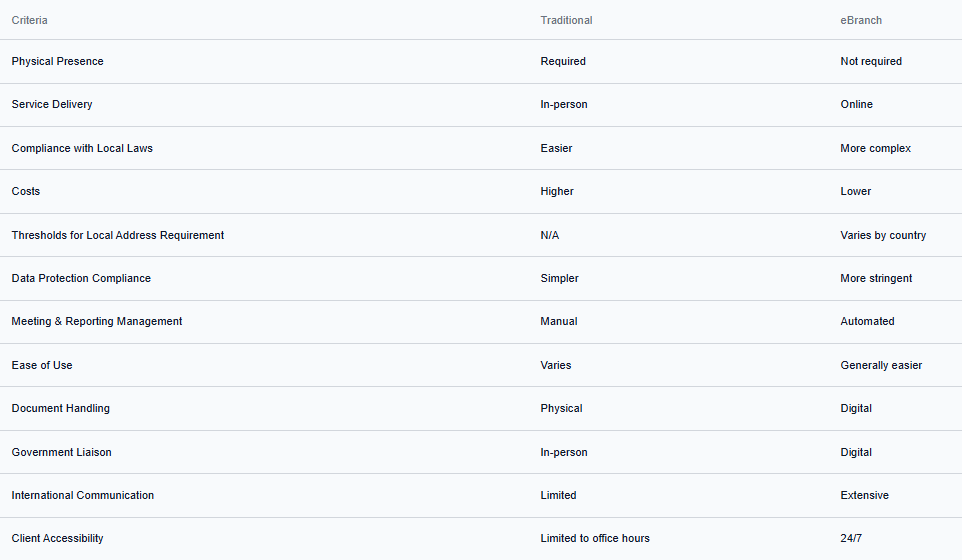

Traditional corporate secretary services in Germany typically involve in-person meetings, paper-based documentation, and a physical local office. This approach offers direct, personal interaction but can be more time-consuming and costly. In contrast, eBranch services represent a modern, digital approach. They utilize virtual meetings, cloud-based document management, and often provide a virtual office solution.

eBranch services offer greater flexibility and can be more cost-effective, especially for smaller businesses or those without a significant physical presence in Germany. However, it’s crucial to ensure that digital solutions comply with German data protection laws and corporate governance requirements, particularly regarding electronic signatures and virtual shareholder meetings.

“House of Companies made setting up our business in Germany seamless. Their corporate secretary services ensured we stayed compliant with all local regulations, allowing us to focus on growth.”

Tech Innovators

Tech Innovators“The local support agent provided by House of Companies was invaluable. They handled all our administrative tasks efficiently, making our market entry smooth and hassle-free.

Global Ventures

Global Ventures“Switching to House of Companies’ eBranch services was a game-changer. The digital approach saved us time and money, while still ensuring we met all legal requirements.”

Green Solutions

Green SolutionsFeel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!