We specialize in helping e-commerce businesses simplify their VAT filing process using the One-Stop Shop (OSS) system in Germany. Whether you’re selling within the EU or expanding into non-EU countries, our OSS services ensure smooth VAT compliance, so you can focus on growing your business without the stress of navigating complex tax rules. Our Entity Management services are designed to support businesses worldwide, especially those looking to enter the German market. From VAT registration to submission, we handle every step, offering complete support to ensure your VAT returns are accurate and filed on time.

Our OSS VAT filing solutions simplify the process, helping you avoid manual errors and reduce administrative tasks. With our advanced tools, you can ensure that your VAT returns are filed correctly and on time, no matter the size or complexity of your business.

We help you register your business for VAT in Germany, making sure that all legal requirements are fully satisfied.

We assist in registering your business for VAT in Germany, ensuring that all legal requirements are met.

We assist in registering your business for VAT in Germany, ensuring that all legal requirements are met.

“Their expertise gave me the confidence to handle more of the tax filing myself, and it made a real difference. Now I’m more involved and comfortable with the process!”

IT Firm Owner

IT Firm Owner“With their support, my accountant in India prepares the VAT reports, and the Entity Management system handles the submission seamlessly. It’s a huge relief!”

Spice & Herbs ExportCEO

Spice & Herbs ExportCEO“We anticipated it would take at least two quarters to establish ourselves in Germany, but thanks to their efficient service, we were up and running much faster. Plus, we saved significantly on accounting fees!”

Global Talent RecruiterCEO

Global Talent RecruiterCEOOur VAT OSS filing process is designed to simplify compliance and streamline your international operations:

Registration and Setup

We handle your VAT OSS registration, ensuring all required details are accurately submitted to the German tax authorities.

Real-Time Reporting

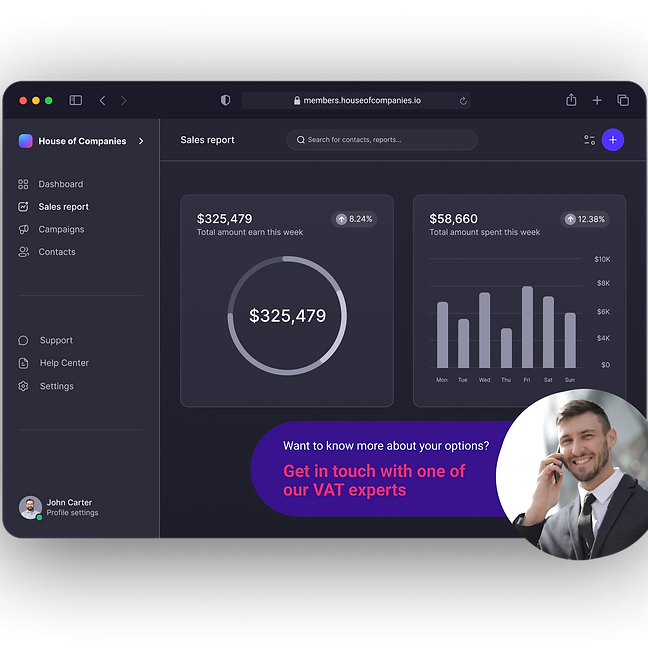

Our platform provides real-time insights, giving you complete visibility of your VAT liabilities across multiple countries.

Automated Filing

We file automatically to guarantee accurate and timely entries, therefore relieving you of any concern about deadlines or penalties.

Constant Compliance Support

Our team of VAT specialists provides continuous support to address any queries or regulatory changes, ensuring you’re always compliant.

The OSS system simplifies VAT compliance for e-commerce businesses selling across EU countries by allowing them to file a single VAT return covering multiple EU countries, including Germany.

Any business selling goods or services to consumers within the EU can use the OSS system, provided they meet the threshold of €10,000 in annual sales across the EU.

Once registered for the OSS scheme, we handle all filings and VAT submissions for your business, consolidating your VAT obligations across EU countries into one return.

No, under the OSS system, you only need to register in one EU country (such as Germany), and you can report all EU sales through a single VAT return.

Yes, non-EU businesses can also benefit from the OSS scheme by registering in an EU country for VAT purposes and consolidating their VAT returns for all EU sales.

OSS returns must be submitted on a quarterly basis. Our team ensures timely filing to help you avoid penalties and ensure compliance.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!