Introduction

As the year 2023 approaches, it’s essential for companies operating in Germany to stay ahead of the game by familiarizing themselves with the latest tax laws. These regulations can have a significant impact on businesses, so understanding them is crucial for both compliance and financial planning.

The 2023 German tax laws for companies bring about several changes that could affect your business. From revised tax rates to new deductions and allowances, keeping up with these updates will enable you to make informed decisions and optimize your tax strategies.

With a focus on transparency and fairness, the German government aims to create a level playing field for businesses while also promoting economic growth. By staying up-to-date with the latest tax laws, companies can take advantage of opportunities for savings, minimize their tax liabilities, and ensure compliance with legal obligations.

In this article, we will delve into the key aspects of the 2023 German tax laws for companies and provide you with practical insights and strategies to navigate these changes successfully. Whether you are a small business owner or a multinational corporation, staying informed about these tax laws will empower you to make the right financial decisions and stay ahead in the competitive landscape.

Changes In The 2023 Tax Laws

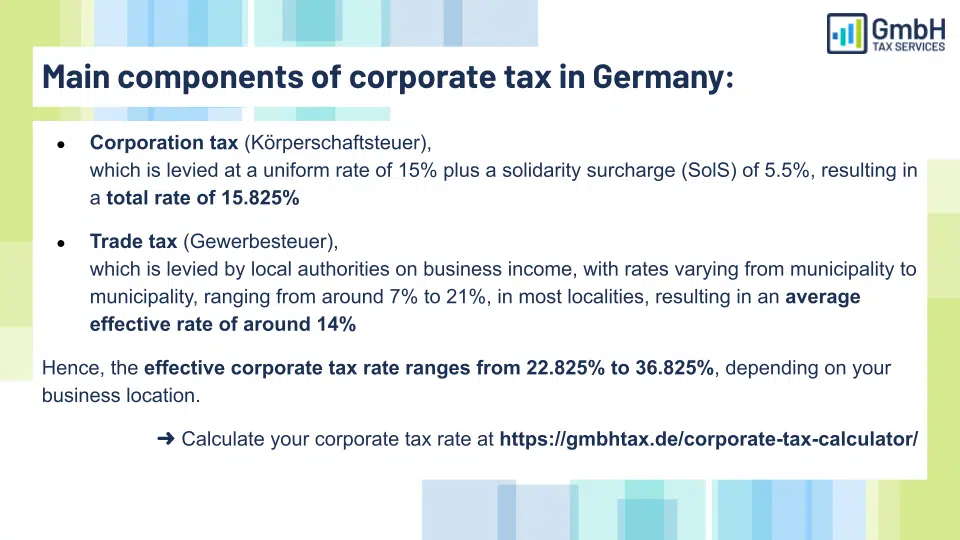

The year 2023 brings forth several significant changes in the German tax laws that companies need to be aware of. One of the key changes is the revision of tax rates. The government has introduced new tax brackets, which may affect the overall tax burden for businesses. It is crucial to understand these new rates to accurately calculate and plan for tax liabilities.

Additionally, there are new deductions and allowances available for businesses. These deductions can help reduce taxable income and potentially lower the tax liability for companies. It is essential to stay informed about these new provisions and take advantage of them to optimize tax strategies and maximize savings.

Another important change is the introduction of stricter regulations on transfer pricing. The German tax authorities are now placing increased scrutiny on intercompany transactions to ensure fair pricing and prevent profit shifting. Companies engaged in international transactions need to carefully review their transfer pricing policies to comply with these new regulations.

Key Provisions And Regulations In The New Tax Laws

The 2023 German tax laws for companies encompass various key provisions and regulations that businesses need to understand. One of the significant provisions is the requirement for mandatory digital tax reporting. Companies are now obligated to submit their tax returns electronically, ensuring efficiency and accuracy in the reporting process.

Furthermore, there are changes in the tax treatment of business expenses. Certain expenses that were previously deductible may now be subject to stricter rules or limitations. It is essential for businesses to review their expense policies and ensure compliance with the new regulations to avoid any penalties or disputes with the tax authorities.

Another crucial aspect of the new tax laws is the focus on environmental sustainability. The German government has introduced incentives and tax breaks for companies engaged in environmentally friendly activities. To take advantage of these incentives, businesses need to invest in sustainable practices and align their operations with the government’s environmental goals.

Impact Of The New Tax Laws On Small Businesses

Small businesses play a vital role in the German economy, and the new tax laws have specific implications for them. One of the key impacts is the simplification of the tax compliance process for small businesses. The government has introduced measures to reduce the administrative burden and facilitate tax reporting for small enterprises.

Additionally, small businesses can benefit from the new deductions and allowances available under the 2023 tax laws. These provisions can help reduce tax liabilities and provide financial relief for small business owners. It is crucial for small businesses to stay informed about these opportunities and leverage them to their advantage.

However, the new tax laws also bring about challenges for small businesses. The stricter regulations on transfer pricing can be particularly burdensome for companies with limited resources and international operations. Small businesses need to ensure compliance with these regulations and seek professional assistance if needed to avoid any penalties or legal issues.

Tax Planning Strategies For Businesses Under The New Laws

With the changes in the German tax laws, businesses need to adapt their tax planning strategies to optimize their financial position. One effective strategy is to review and adjust the company’s legal structure. Restructuring can help minimize tax liabilities and take advantage of the new deductions and allowances available.

Furthermore, businesses should consider implementing tax-efficient employee benefit programs. Offering benefits such as company pension schemes or employee stock options can not only attract and retain talent but also provide tax advantages for both the company and the employees.

Another important aspect of tax planning is to proactively manage cash flow. By forecasting and planning for tax payments, businesses can ensure they have sufficient funds available and avoid any financial strain. It is also advisable to explore tax deferral strategies to maximize cash flow.

Compliance Requirements And Deadlines

Compliance with the new tax laws is crucial to avoid penalties and legal disputes. Companies need to be aware of the filing requirements and deadlines imposed by the tax authorities. It is essential to maintain accurate records and submit tax returns on time to ensure compliance.

To facilitate compliance, businesses should consider implementing robust accounting systems and processes. Automating tax reporting and record-keeping can help streamline operations and minimize the risk of errors or omissions. Regular monitoring and reconciliation of financial data are essential to identify any discrepancies and address them promptly.

Hiring A Tax Consultant For Assistance

Navigating the complexities of the 2023 German tax laws can be challenging for businesses. Engaging the services of a tax consultant can provide valuable guidance and support. A tax consultant can help businesses understand the new regulations, optimize tax planning strategies, and ensure compliance with legal obligations.

When hiring a tax consultant, it is important to choose a reputable and experienced professional. Look for consultants with expertise in German tax laws and a track record of successfully assisting businesses in similar industries. Clear communication and a collaborative approach are essential for a productive working relationship.

Resources For Further Information And Support

Staying informed about the 2023 German tax laws is crucial for businesses. There are various resources available to help companies navigate these changes successfully. The German Federal Ministry of Finance provides official publications and guidelines on the new tax laws, which can be accessed on their website.

Additionally, professional associations and industry-specific organizations often offer seminars, webinars, and workshops on tax law updates. Attending these events can provide valuable insights and networking opportunities. Local chambers of commerce and business associations can also be excellent sources of information and support.

Case Studies: How Businesses Are Adapting To The New Tax Laws

To illustrate the practical implications of the 2023 German tax laws, let’s explore a few case studies of how businesses are adapting to these changes. Case Study 1 focuses on a small manufacturing company that leverages the new deductions to reduce their taxable income and increase cash flow. Case Study 2 examines a multinational corporation that restructures its operations to optimize tax planning and comply with transfer pricing regulations.

These case studies provide real-life examples of how businesses can navigate the complexities of the new tax laws and maximize their financial position. By studying these cases, companies can gain insights and ideas for their own tax strategies.

Conclusion: Navigating The 2023 German Tax Laws For Companies

As the year 2023 approaches, it is crucial for companies operating in Germany to familiarize themselves with the latest tax laws. The changes in the German tax landscape bring about both challenges and opportunities for businesses. By staying informed, understanding the key provisions, and implementing effective tax planning strategies, companies can optimize their financial position, minimize tax liabilities, and ensure compliance with legal obligations.

Navigating the 2023 German tax laws may seem daunting, but with the right knowledge, resources, and professional assistance, businesses can successfully adapt to these changes and thrive in the competitive landscape. Stay proactive, seek expert advice when needed, and take advantage of the available incentives and deductions to optimize your tax strategies and drive sustainable growth for your company.