At House of Companies, we play a pivotal role in assisting foreign businesses and individuals with their financial matters while operating in Germany. Our services are essential to ensure compliance with German tax laws and regulations. From obtaining a VAT number to submitting annual financial statements, we provide comprehensive support to help you fulfill your financial obligations in Germany.

In this article, we explore the key aspects of accounting and tax compliance for non-residents in Germany and highlight how House of Companies has revolutionized and simplified the process of German accounting.

We discuss crucial topics such as corporate income tax, bookkeeping standards, and the advantages of the German tax regime. By understanding these elements, you can effectively manage your finances and leverage opportunities in the German business environment.

For non-resident businesses entering the German market, understanding local accounting and tax regulations is crucial to ensure smooth operations and compliance. German accounting services are essential for foreign companies navigating the complexities of tax laws, from obtaining a VAT number to submitting annual reports. These services help non-residents meet their financial obligations while avoiding penalties and staying on the right side of German tax regulations.

This article explores key aspects of accounting and tax compliance for foreign companies in Germany, with a special focus on how House of Companies simplifies and streamlines the process for businesses worldwide. Topics such as corporate income tax, bookkeeping rules, and exemptions are covered, providing a clear understanding of how non-resident companies can manage their finances and leverage opportunities in the German market.

Foreign companies operating in Germany must navigate the country’s accounting services and tax compliance framework. This article highlights critical areas such as corporate income tax, bookkeeping rules, and participation exemptions, giving insight into how the German tax system works. Understanding these elements is crucial for businesses to successfully manage their financial duties and take full advantage of opportunities in Germany’s business landscape.

The complexity of German accounting rules makes expert guidance essential to avoid penalties and ensure compliance. By staying informed and meeting deadlines, foreign companies can focus on their core business while remaining in good standing with German authorities.

House of Companies offers accounting software solutions, demos, and financial reports to help businesses optimize their tax compliance processes in Germany.

Germany operates under a robust accounting and financial reporting system, governed by the German Commercial Code (HGB) and supplemented by international standards such as IFRS for publicly listed companies. Companies are required to prepare and submit annual financial statements, which must be audited if the company exceeds certain thresholds in size or revenue. These statements include balance sheets, income statements, and notes, and must be filed with the local trade registry.

In addition, businesses must comply with specific reporting deadlines and requirements, such as submitting annual reports within a set period after the financial year ends. Companies in specific industries, like extractive industries, may also need to report additional information on payments to governments.

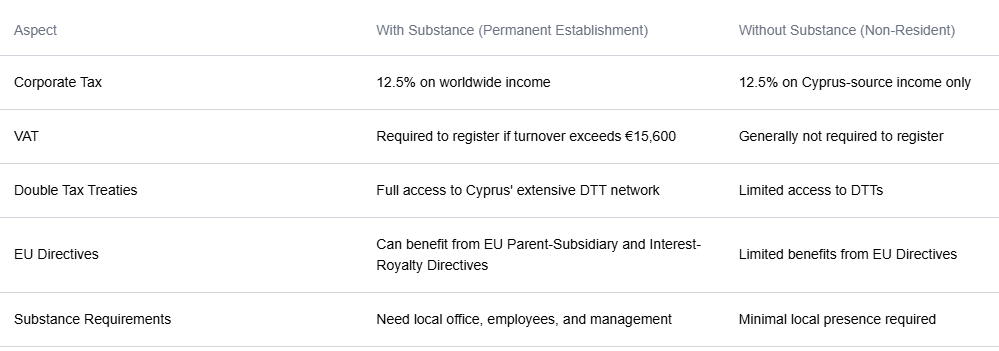

For corporate tax purposes in Germany, a company with substance, i.e., a permanent establishment (PE), is subject to corporate income tax (CIT) on its worldwide income. In contrast, a non-resident company without a PE in Germany is only liable for CIT on German-source income, such as profits generated from a PE or income derived from German real estate.

The term ‘permanent establishment’ is defined under German tax law and aligns with the definition provided in the applicable international tax treaties. For non-treaty situations, the definition follows the guidelines of the OECD Model Tax Convention.

Regarding value-added tax (VAT), a German company with substance must register for VAT and charge VAT on its taxable supplies of goods and services. A non-resident company without a PE in Germany may still be required to register for VAT if it engages in taxable activities within the country, such as distance sales or e-services provided to customers who are not VAT-registered.

Non-resident entities seeking to establish a presence in Germany have several legal entity options, each with its own set of accounting and tax implications. The most common types include branch offices, subsidiaries, and foreign legal structures.

Branch Offices (Permanent Establishments): A branch office, also known as a permanent establishment (PE), is not a separate legal entity but an extension of the foreign parent company. It must be registered with the German Trade Register (Handelsregister) and is subject to corporate income tax and VAT on profits attributable to the branch. The branch office itself does not need to file separate financial statements with the German authorities, but the parent company’s financial statements must be submitted.

Subsidiaries: A subsidiary is an independent legal entity incorporated under German law. It must register with the German Trade Register and comply with all tax obligations, including corporate income tax, VAT, and wage tax. Subsidiaries are required to file annual financial statements and enjoy greater administrative independence compared to branch offices.

Foreign Legal Structures: Foreign companies can also choose to operate in Germany using their home country’s legal structure. German company law recognizes most foreign business structures, but sole proprietorships are not permitted. However, using a foreign legal structure may lead to additional complexity, including the need to deal with multiple tax authorities and legal systems.

Registering a branch office in Germany comes with several accounting obligations. The branch must maintain proper books and records, and the foreign company is required to submit its financial statements to the German Trade Register (Handelsregister). If the branch has employees, it must establish a German payroll system, ensuring the correct withholding of wage tax and social security contributions.

The branch office’s profits are subject to German corporate income tax (CIT), and it must file regular VAT returns, typically on a quarterly basis. Transfer pricing rules apply to transactions between the branch and its foreign parent company, meaning that the allocation of profits must be properly documented to meet German tax regulations.

The decision to establish a branch office, subsidiary, or use a foreign legal structure in Germany depends on factors such as the nature of the business, the scale of operations, tax considerations, and administrative efficiency.

Non-resident entities should seek advice from legal and tax professionals to determine the most appropriate structure for their specific needs. House of Companies offers tailored support through a corporate planning service, available for a fixed fee of €295.

Non-resident entities operating in Germany must comply with various tax registration requirements to ensure adherence to German regulations. These obligations include registering for value-added tax (VAT), payroll taxes, and corporate income tax, depending on the nature and extent of their business activities in the country.

Businesses engaged in VAT taxable transactions in Germany are required to register for a German VAT number. This applies to both resident and non-resident companies supplying goods or services (or importing) within the country.

The registration process involves submitting an application to the German tax authorities, providing necessary documentation such as proof of business incorporation and identification documents, and appointing a fiscal representative for non-resident businesses.

House of Companies has automated the process of obtaining a VAT number through our eBranch portal. Once registered, companies must charge VAT on their supplies, file periodic VAT returns, and maintain proper records of their transactions. The standard VAT rate in Germany is 19%, with a reduced rate of 7% applicable to certain goods and services. Non-compliance with VAT obligations can result in penalties and legal consequences.

Businesses employing staff in Germany are required to register as an employer with the German tax authorities (Finanzamt) and deduct payroll taxes from their employees’ wages.

Payroll taxes in Germany include income tax, social security contributions, and employee insurance premiums. These taxes must be withheld from employees’ wages and remitted to the tax authorities by the employer.

Employers must file payroll tax returns on a regular basis (usually monthly) and ensure that the correct amounts are paid to the relevant authorities.

Before hiring staff, companies must register as an employer and obtain a tax identification number (Steuernummer) for payroll purposes. They must also verify their employees’ identities and their eligibility to work in Germany. Non-compliance with payroll tax obligations can lead to significant penalties and legal consequences.

Tip: It is not necessary to establish a local company or a branch office in Germany to comply with payroll tax regulations, unless you are outsourcing staff to third parties (temporary agency employment).

resident companies are subject to corporate income tax on their worldwide income. The standard corporate tax rate is 15%, with an additional solidarity surcharge of 5.5% on the corporate tax amount, bringing the effective tax rate to around 15.83%. Companies are required to file annual corporate income tax returns and make advance tax payments throughout the year.

For small and medium-sized enterprises (SMEs), there is a reduced rate of 9% for profits up to €100,000 (in 2023), which helps alleviate the tax burden on smaller businesses. However, this reduced rate is only applicable for certain eligible entities and within specific thresholds.

Non-resident companies, on the other hand, are only liable for corporate income tax on income generated within Germany, such as profits from a permanent establishment or income derived from German real estate. These companies must file corporate tax returns and pay taxes based on their German-source income.

A key consideration for businesses is: Is my company considered a resident in Germany? In general, companies incorporated under German law are deemed “resident” for tax purposes, unless a tax treaty exists or they do not meet the necessary substance requirements.

This means that while you can establish a company in Germany, your profits may not necessarily be subject to German tax if the effective management and control of the company is exercised in another jurisdiction. For more insights on this topic, check out our blog!

Non-resident entities operating in Germany are subject to various bookkeeping and financial reporting obligations, as outlined by German law. These requirements are primarily governed by the German Commercial Code (Handelsgesetzbuch, HGB) and the International Financial Reporting Standards (IFRS), depending on the company’s size and specific circumstances.

Most German corporate entities must prepare financial statements in accordance with legal requirements, which are typically specified in the company’s statutes or articles of incorporation.

The preparation of financial statements is not only crucial for legal compliance but also forms the foundation for corporate governance and taxation in Germany. These financial statements are used to determine the taxable income of the company, although tax regulations follow separate rules from accounting standards.

The content of financial statements in Germany varies based on the size of the company and its legal obligations, but generally includes the following:

Income Statement (Gewinn- und Verlustrechnung)

The financial statements must reflect the company’s actual financial position. The accounting principles applied should be clearly outlined in the statements. Once established, these principles can only be modified with valid reasoning, and any changes must be explained in the notes, along with the impact on the company’s financial standing.

Consolidation requirements are governed by the German Commercial Code (Handelsgesetzbuch, HGB) and the International Financial Reporting Standards (IFRS) for publicly traded companies. Companies are required to prepare consolidated financial statements if they have control over one or more subsidiaries. Control is typically defined as having the power to govern the financial and operating policies of an entity to obtain benefits from its activities. This includes holding more than 50% of the voting rights or having the ability to appoint or remove the majority of the board of directors.

The consolidated financial statements must include a balance sheet, income statement, cash flow statement, statement of changes in equity, and notes to the financial statements. These statements provide a comprehensive view of the financial position and performance of the entire group of companies as if they were a single economic entity. The purpose of consolidation is to eliminate intra-group transactions and balances to avoid double counting and to present a true and fair view of the group’s financial health. Companies that meet certain size criteria, such as exceeding specific thresholds for total assets, turnover, or number of employees, are mandated to prepare consolidated financial statements.

Exemptions from consolidation are available under certain conditions. For instance, if the parent company itself is a subsidiary of another company that prepares consolidated financial statements, it may be exempt from this requirement. Additionally, small groups that do not exceed specific thresholds for total assets, turnover, and employees may also be exempt. However, these exemptions must be carefully evaluated, and companies must ensure compliance with both national and international accounting standards to avoid legal and financial repercussions.

In Germany, consolidation requirements are primarily governed by the German Commercial Code (Handelsgesetzbuch, HGB) and the International Financial Reporting Standards (IFRS). Companies that are part of a group must prepare consolidated financial statements if they meet certain criteria. These criteria include having control over one or more subsidiaries, which typically means holding more than 50% of the voting rights.

The process of consolidation involves combining the financial statements of the parent company with those of its subsidiaries. This ensures that the financial position and performance of the entire group are presented as a single economic entity. Key steps in the consolidation process include eliminating intercompany transactions and balances, adjusting for minority interests, and harmonizing accounting policies across the group.

German law requires that consolidated financial statements provide a true and fair view of the group’s financial situation. This involves adhering to specific accounting principles and standards, such as the HGB or IFRS, depending on the size and nature of the company. Large companies and those listed on the stock exchange are typically required to use IFRS, while smaller companies may use HGB.

There are exemptions available for certain small and medium-sized enterprises (SMEs). Under specific conditions, these companies may be exempt from preparing consolidated financial statements. For example, if the parent company and its subsidiaries collectively fall below certain size thresholds, they might not be required to consolidate.

The financial statements must be prepared and approved by the managing directors no later than five months after the end of the financial year, with a possible extension of up to five months. The publication requirements vary depending on the company’s size, as summarized in the table below:

Non-resident entities must comply with bookkeeping and financial reporting requirements to ensure adherence to German regulations and maintain transparency in their business operations.

In Germany, the filing of annual accounts is a critical obligation for businesses to ensure transparency and compliance with legal requirements. The German Commercial Code (Handelsgesetzbuch, HGB) outlines the specific requirements for the preparation and filing of annual financial statements.

All companies, regardless of size, must prepare annual financial statements. These typically include a balance sheet, profit and loss statement, and notes to the accounts. Larger companies may also need to prepare a management report.

Depending on the size of the company, an audit of the financial statements may be required. Large and medium-sized companies must have their financial statements audited by an independent auditor. Small companies are generally exempt from this requirement.

Non-resident entities operating in Germany are subject to specific audit requirements to ensure transparency and compliance with local regulations. These requirements are primarily governed by the German Commercial Code (Handelsgesetzbuch, HGB) and are designed to provide a true and fair view of the financial position of the entity.

Non-resident entities must prepare annual financial statements, which include a balance sheet, profit and loss statement, and notes to the accounts. If the non-resident entity meets certain size criteria, such as exceeding thresholds for total assets, turnover, or number of employees, it is required to have its financial statements audited by an independent auditor.

The audit process involves a thorough examination of the financial statements to verify their accuracy and compliance with applicable accounting standards. The auditor will assess the entity’s internal controls, accounting practices, and financial reporting to ensure that the financial statements present a true and fair view of the entity’s financial position.

Non-compliance with audit requirements can result in significant penalties, including fines and legal action. Therefore, it is crucial for non-resident entities to understand and adhere to these requirements to maintain credibility and avoid potential legal issues in Germany.

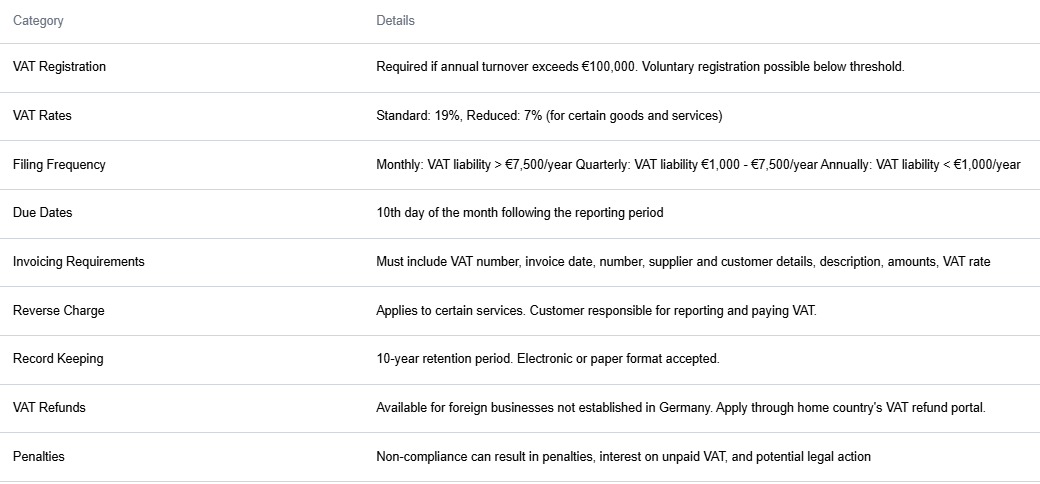

Foreign businesses operating in Germany must adhere to specific VAT compliance requirements to ensure proper tax reporting and payment.

Foreign businesses must register for VAT in Germany if they engage in taxable transactions within the country. This includes selling goods or services to German customers. The registration process involves obtaining a German VAT identification number from the Federal Central Tax Office (Bundeszentralamt für Steuern).

The standard VAT rate in Germany is 19%, with a reduced rate of 7% for certain goods and services. Foreign businesses must issue invoices that comply with German VAT regulations, including displaying the correct VAT rate and the VAT identification number.

Foreign businesses are required to file regular VAT returns, usually on a monthly or quarterly basis, depending on their turnover. These returns must detail the VAT collected from sales and the VAT paid on purchases. The returns are submitted electronically through the German tax authorities’ online portal.

Any VAT owed must be paid to the German tax authorities by the due date specified in the VAT return. Foreign businesses may also be eligible to claim refunds for VAT paid on business expenses incurred in Germany, subject to certain conditions and documentation requirements.

Compliance with these VAT obligations is crucial for foreign businesses to avoid penalties and ensure smooth operations in Germany.

When evaluating financial reporting standards in Germany, companies primarily choose between the German Commercial Code, known as Handelsgesetzbuch (HGB), and the International Financial Reporting Standards (IFRS). Each framework caters to different reporting needs and presents unique principles and practices. Here’s a closer look at how these standards compare:

German HGB is deeply rooted in the principle of creditor protection, prioritizing a conservative approach to ensure the financial stability of companies. This standard emphasizes the reliability of financial reporting by focusing on prudent valuations and historical cost accounting. HGB is commonly used by small and medium-sized enterprises (SMEs) and privately held companies within Germany.

IFRS is an international standard designed to provide transparency, comparability, and consistency in financial reporting. This framework is more focused on fair value measurement and aims to present an accurate and current depiction of a company’s financial position. IFRS is generally required for publicly listed companies in Germany and is favored by large multinational corporations for its global applicability.

Dividends from German resident corporations are generally subject to a 25% withholding tax (WHT) as stipulated by the German Income Tax Act (Einkommensteuergesetz). Additionally, a solidarity surcharge of 5.5% on the WHT may apply, bringing the total rate slightly higher.

However, exemptions or reductions may be available under certain conditions. If the recipient of the dividends is a resident within the European Union (EU) or European Economic Area (EEA), or a country that holds a double taxation agreement (DTA) with Germany, reduced rates or full exemptions may apply, contingent on meeting anti-abuse regulations outlined in German tax law.

A foreign entity with a branch in Germany is not required to prepare separate German financial statements for the branch itself, although a stand-alone balance sheet and profit and loss account may be needed for tax purposes. As the branch is an extension of the parent company and not a separate legal entity, transactions between the head office and the German branch do not result in withholding tax obligations.

Parent companies must generally consolidate the financial information of their subsidiaries and affiliated group companies in their financial statements. Under German law, a “controlled subsidiary” is defined as an entity where the parent company directly or indirectly holds more than 50% of the voting rights or can appoint or remove the majority of the management or supervisory board members. This requirement aligns with the provisions under the Handelsgesetzbuch (HGB) and EU Directives applicable to German financial reporting.

Dividends received from a subsidiary should be recognized as financial income in the parent company’s profit and loss account. The corresponding receivable is recorded as an asset on the balance sheet until the payment is made.

Outgoing dividends to shareholders are reflected as a reduction in retained earnings on the balance sheet. This is paired with the recording of a liability until the actual payment is distributed, ensuring accurate representation of the company’s financial position.

According to the German Commercial Code (Handelsgesetzbuch, HGB), companies must prepare their annual financial statements within three to six months following the close of their financial year, depending on their classification (small, medium-sized, or large enterprises). For large and medium-sized companies, financial statements should typically be prepared within the first three months. Small enterprises may have up to six months to complete their reporting.

Once approved, the financial statements must be submitted to the Federal Gazette (Bundesanzeiger) without delay. The submission includes:

If the financial statements have not been adopted within the deadline, the company must still file the prepared financial statements along with a statement indicating they are yet to be approved.

Failure to comply with filing and reporting requirements can result in fines and penalties under the German Gesetz über Ordnungswidrigkeiten (Administrative Offenses Act). Management board members may also be held personally liable for any damages incurred by third parties due to non-compliance with filing obligations.

To ensure adherence to German accounting regulations, companies, especially non-resident entities, should stay informed about the annual reporting deadlines and seek professional assistance as necessary.

Per the German Commercial Code (HGB), audit requirements depend on the company’s size classification, based on three factors: total assets, net turnover, and the number of employees. Companies must meet at least two of the three criteria for their respective category in two consecutive years (or the first year for newly established companies) to determine their classification.

Audit Thresholds in Germany:

EU Audit Requirements Comparison

Small companies are not required by law to have an external audit, allowing them to submit unaudited financial statements. Medium and large companies, however, must ensure their statements are audited by a certified and qualified German auditor. This audit confirms that the financial statements adhere to German GAAP and accurately reflect the company’s financial health.

Non-resident entities operating in Germany should familiarize themselves with these audit thresholds to remain compliant. Seeking guidance from legal and financial experts can help determine appropriate measures based on a company’s unique structure and obligations.

What is the deadline for filing financial statements in Germany?

Companies in Germany must prepare their annual financial statements within three to six months after the fiscal year ends. Large and medium-sized companies generally have a three-month window, while small companies can take up to six months. Approved financial statements must be filed promptly with the Federal Gazette (Bundesanzeiger).

Do small companies in Germany need an audit?

No, small companies in Germany are not legally required to have their financial statements audited. Only medium-sized and large companies must undergo an external audit by an independent, certified auditor.

What happens if a company fails to meet the reporting deadline?

Failure to meet the reporting and filing deadlines can lead to fines and penalties as per the Administrative Offenses Act (Gesetz über Ordnungswidrigkeiten). In severe cases, management board members may be held personally liable for any resulting damages.

What are the key differences between audit thresholds for small and large companies in Germany?

Small companies are defined as those with up to €6 million in total assets, €12 million in net turnover, and up to 50 employees. They do not require an audit. Medium and large companies exceeding these thresholds must comply with statutory audit requirements to ensure the accuracy and transparency of their financial statements.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!