Introduction

In the world of finance, making informed decisions is the key to success for any business. One important metric that helps businesses make better financial decisions is EBIT, or Earnings Before Interest and Taxes. Understanding EBIT can provide valuable insights into a company’s profitability and operational efficiency.

What Is EBIT?

EBIT is a measure of a company’s operating income before deducting interest and taxes. It helps business owners and investors to evaluate the company’s core profitability, separate from the impacts of taxes and financing. By focusing on EBIT, businesses can gain a clearer picture of their ability to generate profits from their operations alone.

EBIT is calculated by subtracting operating expenses, such as cost of goods sold, salaries, and rent, from total revenue. This metric excludes non-operating income and expenses, such as interest income and interest expense, as well as income tax expenses. By focusing solely on operating income, EBIT provides a more accurate representation of a company’s ability to generate profits from its core operations.

Understanding EBIT is essential for businesses of all sizes and industries. It allows them to assess their operational efficiency and profitability, enabling them to make better-informed financial decisions.

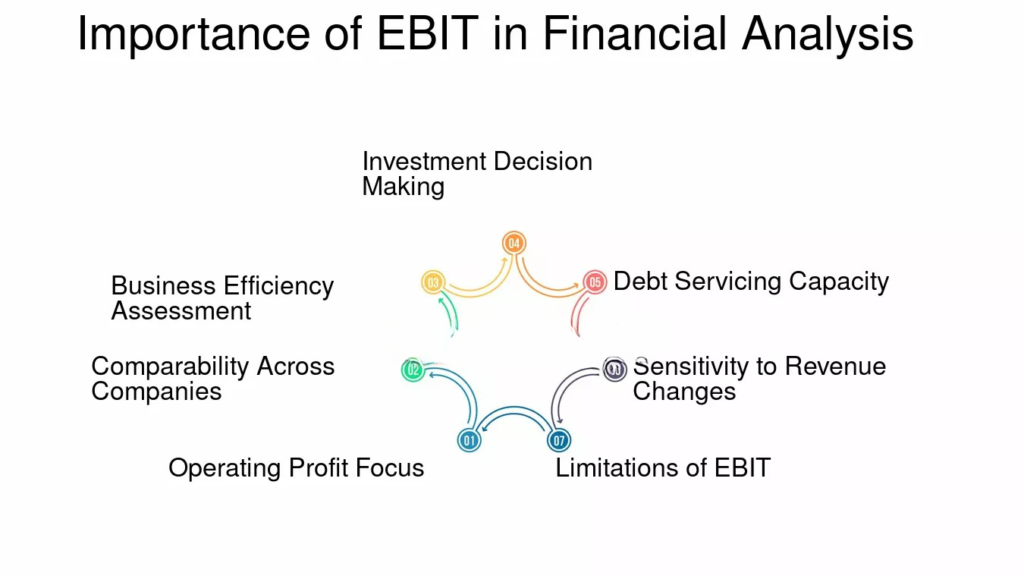

Importance Of Understanding EBIT For Businesses

EBIT is a powerful tool for businesses, enabling them to make better financial decisions. Here are some key reasons why understanding EBIT is crucial for businesses:

Assessing Profitability

By focusing on EBIT, businesses can evaluate their core profitability, separate from the impacts of taxes and financing. This can help them identify areas where they can improve their operational efficiency and increase their profitability. By analyzing the trends in EBIT over time, businesses can also track their financial performance and identify potential issues or opportunities.

Comparing Performance

EBIT is not only useful for internal decision-making but also for external stakeholders, such as investors and lenders. It allows them to assess a company’s financial health and compare its performance to industry peers. Investors often use EBIT as a key metric to evaluate a company’s profitability and determine its value. Lenders, on the other hand, use EBIT to assess a company’s ability to generate sufficient cash flow to cover its debt obligations.

Making Investment Decisions

Understanding EBIT is crucial for businesses when making investment decisions. By analyzing the EBIT of potential investment opportunities, businesses can assess their potential profitability and make informed decisions about resource allocation. EBIT can help businesses evaluate the return on investment (ROI) of different projects or initiatives, allowing them to prioritize and allocate resources effectively.

Cost Management

EBIT provides a valuable tool for businesses to manage their costs effectively. By analyzing the components of EBIT, businesses can identify areas where they can reduce costs and increase profitability. For example, if a company’s EBIT is lower than expected, it may indicate that its operating expenses are too high. By analyzing and optimizing these expenses, businesses can improve their EBIT and overall financial performance.

Pricing Strategies

Understanding EBIT can also help businesses set appropriate pricing strategies. By analyzing the relationship between revenue, costs, and EBIT, businesses can determine the optimal price point for their products or services. Pricing too low may result in lower profitability, while pricing too high may lead to decreased sales. By considering the impact of pricing decisions on EBIT, businesses can strike the right balance and maximize their profitability.

How To Calculate EBIT

Calculating EBIT is relatively straightforward. Here’s the formula for calculating EBIT:

EBIT = Total Revenue Operating Expenses

Operating expenses include costs such as cost of goods sold, salaries, rent, utilities, and other expenses directly related to a company’s core operations. It’s important to exclude non-operating income and expenses, such as interest income and interest expense, as well as income tax expenses, when calculating EBIT.

Let’s consider an example to illustrate the calculation of EBIT. ABC Company has total revenue of $1,000,000 and operating expenses of $800,000. To calculate ABC Company’s EBIT, we subtract the operating expenses from the total revenue:

EBIT = $1,000,000 $800,000 = $200,000

ABC Company’s EBIT is $200,000. This metric provides valuable insights into the company’s core profitability, separate from the impacts of taxes and financing.

EBIT Vs. Net Income: Understanding The Difference

While EBIT provides insights into a company’s operational profitability, it’s important to distinguish it from net income. Net income, also known as net profit or net earnings, represents a company’s total profit after deducting all expenses, including taxes and interest.

The main difference between EBIT and net income is that EBIT focuses solely on operating income, excluding non-operating income and expenses such as interest and taxes. Net income, on the other hand, represents the company’s final profit after deducting all expenses, including taxes and interest, from its total revenue.

Understanding the difference between EBIT and net income is crucial for businesses to make informed financial decisions. EBIT provides insights into a company’s operational profitability, while net income represents the company’s overall financial performance, including the impacts of taxes and financing.

Using EBIT To Assess Profitability

EBIT is a powerful metric for assessing a company’s profitability. By analyzing the trends in EBIT over time, businesses can evaluate their operational efficiency and identify potential areas for improvement. Here are some key factors to consider when using EBIT to assess profitability:

EBIT Margin

EBIT margin, also known as operating margin, is a valuable metric for assessing a company’s profitability. It represents the percentage of revenue that remains as operating income after deducting operating expenses. A higher EBIT margin indicates a higher level of profitability, as it means that a larger portion of revenue is contributing to operating income.

To calculate EBIT margin, divide EBIT by total revenue and multiply by 100:

EBIT margin = (EBIT / Total Revenue) * 100

For example, if a company has an EBIT of $200,000 and total revenue of $1,000,000, the EBIT margin would be:

EBIT margin = ($200,000 / $1,000,000) * 100 = 20%

A higher EBIT margin indicates a higher level of profitability, as it means that a larger portion of revenue is contributing to operating income.

EBIT Vs. Industry Benchmarks

Comparing a company’s EBIT to industry benchmarks can provide valuable insights into its profitability. By analyzing how a company’s EBIT compares to industry peers, businesses can assess their competitive position and identify potential areas for improvement.

Industry benchmarks can be obtained from various sources, such as industry reports, financial databases, or trade associations. By comparing a company’s EBIT to industry benchmarks, businesses can gain a better understanding of their performance and identify potential areas for improvement.

EBIT Trend Analysis

Analyzing the trends in EBIT over time is crucial for businesses to evaluate their financial performance. By comparing EBIT from different periods, businesses can identify patterns and trends that may indicate potential issues or opportunities.

For example, if a company’s EBIT has been consistently declining over several quarters, it may indicate that its operational efficiency or profitability is decreasing. On the other hand, if a company’s EBIT has been consistently increasing, it may indicate that its operational efficiency or profitability is improving.

By analyzing the trends in EBIT over time, businesses can proactively identify potential issues or opportunities and make informed financial decisions.

EBIT And Financial Decision-Making

EBIT plays a crucial role in financial decision-making for businesses. By understanding and incorporating EBIT into their financial analysis, businesses can make better-informed decisions regarding investments, cost management, and pricing strategies. Here are some key areas where EBIT can influence financial decision-making:

Investment Decisions

When making investment decisions, businesses need to assess the potential profitability of different projects or initiatives. By analyzing the EBIT of potential investment opportunities, businesses can evaluate their potential financial returns and make informed decisions about resource allocation.

For example, if a company is considering investing in a new product line, analyzing the potential EBIT of the new product line can help determine its profitability. By comparing the potential EBIT of the new product line to the company’s overall EBIT, businesses can assess the impact of the investment on their financial performance and make informed decisions.

Cost Management

EBIT provides valuable insights into a company’s operating expenses and can help identify areas where costs can be reduced. By analyzing the components of EBIT, businesses can identify specific expenses that can be optimized or eliminated to improve profitability.

For example, if a company’s EBIT is lower than expected, analyzing the operating expenses can help identify areas where costs can be reduced. This may involve renegotiating vendor contracts, optimizing production processes, or implementing cost-saving initiatives.

By analyzing and optimizing operating expenses, businesses can improve their EBIT and overall financial performance.

Pricing Strategies

Understanding the relationship between revenue, costs, and EBIT is crucial for setting appropriate pricing strategies. By considering the impact of pricing decisions on EBIT, businesses can strike the right balance between maximizing revenue and profitability.

For example, if a company’s EBIT margin is low, it may indicate that its pricing strategy is not generating sufficient profitability. By analyzing the relationship between pricing, costs, and EBIT, businesses can determine the optimal price point for their products or services.

By setting appropriate pricing strategies, businesses can maximize their profitability and financial performance.

Case Studies: How Businesses Have Used EBIT To Make Better Financial Decisions

Real-life examples can provide valuable insights into how businesses have used EBIT to make better financial decisions. Here are two case studies that highlight the practical application of EBIT in decision-making:

Case Study 1: Company A’s Cost Management

Company A, a manufacturing company, was experiencing declining profitability and wanted to identify areas where costs could be reduced. By analyzing the components of EBIT, Company A identified that its operating expenses were higher than industry benchmarks.

Company A conducted a comprehensive review of its operating expenses and identified opportunities for cost reduction. It renegotiated vendor contracts, optimized its production processes, and implemented cost-saving initiatives. As a result, Company A was able to reduce its operating expenses and improve its EBIT.

The analysis of EBIT helped Company A identify specific areas where costs could be reduced, leading to improved profitability and financial performance.

Case Study 2: Company B’s Investment Decision

Company B, a technology company, was considering investing in a new product line. To assess the potential profitability of the new product line, Company B analyzed the potential EBIT of the new product line.

By comparing the potential EBIT of the new product line to its overall EBIT, Company B determined that the investment would have a positive impact on its financial performance. Company B decided to allocate resources to the new product line, resulting in increased revenue and profitability.

The analysis of EBIT helped Company B evaluate the potential financial returns of the investment and make an informed decision about resource allocation.

Common Misconceptions About EBIT

Despite its importance, there are some common misconceptions about EBIT. Here are a few misconceptions that should be clarified:

EBIT Is The Same As Net Income

While EBIT provides valuable insights into a company’s operational profitability, it’s important to distinguish it from net income. EBIT represents a company’s operating income before deducting interest and taxes, while net income represents the company’s final profit after deducting all expenses, including taxes and interest, from its total revenue.

EBIT Is The Only Metric To Consider

While EBIT is a powerful metric for assessing a company’s profitability, it should not be the only metric considered. Businesses should also analyze other financial metrics, such as net income, cash flow, and return on investment, to gain a comprehensive understanding of their financial performance.

EBIT Is Always Positive

EBIT can be positive or negative, depending on a company’s financial performance. A positive EBIT indicates that a company’s operating income exceeds its operating expenses, while a negative EBIT indicates that a company’s operating expenses exceed its operating income.

It’s important to analyze the factors contributing to a negative EBIT and take appropriate measures to improve profitability.

Resources For Learning More About EBIT

Understanding EBIT is crucial for businesses to make better financial decisions. Here are some resources that can help business owners and investors learn more about EBIT:

Books: “Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports” by Thomas R. Ittelson and “Financial Intelligence, Revised Edition: A Manager’s Guide to Knowing What the Numbers Really Mean” by Karen Berman and Joe Knight.

Online Courses: Websites like Coursera, Udemy, and LinkedIn Learning offer online courses on financial analysis and accounting that cover topics related to EBIT.

Financial Websites: Websites such as Investopedia, Financial Times, and Wall Street Journal provide valuable resources and articles on financial analysis and metrics, including EBIT.

By leveraging these resources, business owners and investors can deepen their understanding of EBIT and its implications for financial decision-making.

Conclusion

Understanding EBIT is essential for businesses to make better financial decisions. EBIT provides valuable insights into a company’s profitability and operational efficiency, enabling businesses to assess their financial health, make informed investment decisions, manage costs effectively, and set appropriate pricing strategies.

By analyzing EBIT and incorporating it into their financial analysis, businesses can navigate the complex world of finance with confidence. With the valuable insights provided by EBIT, businesses can make better-informed decisions, optimize their financial performance, and achieve long-term success.