Introduction

Running a business involves navigating a complex web of financial responsibilities, and one of the key areas that can significantly impact a company’s operations is the Value Added Tax (MWSt). MWSt, which stands for “Mehrwertsteuer,” is a tax imposed on the sale of goods and services in many countries. Understanding how MWSt affects businesses is crucial for smooth financial management.

In today’s article, we will delve into the impacts of MWSt on businesses and their financial operations. From its effects on pricing and profit margins to its influence on cash flow and compliance, businesses must carefully consider the implications of MWSt to ensure their financial stability and success.

By exploring real-life examples and expert insights, we will provide a comprehensive overview of the ways MWSt can shape a company’s financial landscape. Whether you’re a small business owner or a financial professional, this article will equip you with the knowledge and strategies needed to navigate the complexities of MWSt and optimize your business’s financial performance.

Join us as we unravel the mysteries of MWSt and discover how to effectively manage this crucial aspect of business finance.

Understanding The Concept Of MWSt

MWSt, or Value Added Tax, is a consumption tax imposed on the value added to goods and services at each stage of production and distribution. It is a key component of many countries’ tax systems and is typically a percentage of the final sale price. The purpose of MWSt is to generate revenue for the government and to shift the burden of taxation from income to consumption.

MWSt rates and exemptions vary by country, and businesses must understand the specific regulations in their jurisdiction. In some countries, there may be different MWSt rates for different types of goods or services, such as a reduced rate for essential items or a higher rate for luxury goods. Additionally, certain goods and services may be exempt from MWSt altogether, such as healthcare, education, and financial services.

It’s important for businesses to familiarize themselves with the MWSt regulations in their country and ensure compliance to avoid penalties and legal issues. Failure to correctly charge and remit MWSt can result in financial consequences and damage to a company’s reputation. Now let’s explore how MWSt impacts pricing and revenue.

How MWSt Affects Pricing And Revenue

MWSt has a direct impact on pricing and revenue for businesses. When a business sells a product or service, it must add MWSt to the sales price, effectively increasing the overall cost to the customer. As a result, businesses need to carefully consider the implications of MWSt on their pricing strategies and profit margins.

In some cases, businesses may choose to absorb the MWSt cost themselves, reducing their profit margins to remain competitive in the market. This can be particularly challenging for small businesses with tight profit margins, as absorbing MWSt can eat into their financial resources. Alternatively, businesses may pass on the MWSt cost to the customer, resulting in higher prices. This strategy requires careful consideration, as it may impact customer demand and competitiveness.

Furthermore, MWSt can also impact revenue by influencing consumer behavior. Higher MWSt rates may discourage consumers from making certain purchases, leading to reduced sales volumes. Conversely, lower MWSt rates or exemptions on certain goods or services may incentivize consumer spending. Businesses need to analyze the potential impact of MWSt on consumer behavior and adjust their pricing and revenue forecasts accordingly.

To effectively manage the impact of MWSt on pricing and revenue, businesses should conduct thorough market research, analyze consumer behavior patterns, and regularly review their pricing strategies. It’s essential to strike a balance between remaining competitive in the market and maintaining healthy profit margins.

MWSt Implications For Financial Planning And Budgeting

MWSt plays a significant role in financial planning and budgeting for businesses. As MWSt is a tax that must be collected and remitted to the government, businesses need to ensure they have the necessary funds available to meet their MWSt obligations. Failure to accurately plan for MWSt payments can lead to cash flow issues and potential penalties.

When creating a financial plan and budget, businesses must consider the MWSt rates applicable to their goods or services and estimate the amount of MWSt they will collect from customers. It’s important to consider any exemptions or reduced rates that may apply. By accurately forecasting MWSt revenues, businesses can better manage their cash flow and avoid unexpected financial hurdles.

Additionally, businesses should also consider the timing of MWSt payments and refunds. MWSt payments are typically made on a regular basis, such as monthly or quarterly, depending on the country’s regulations. On the other hand, businesses may be eligible for MWSt refunds on certain business expenses. Understanding the MWSt payment and refund schedule is crucial for accurate financial planning and budgeting.

To effectively manage the MWSt implications for financial planning and budgeting, businesses should implement robust accounting systems and processes. Utilizing accounting software that can handle MWSt calculations and reporting can streamline financial operations and reduce the risk of errors.

Compliance And Reporting Requirements Related To MWSt

Compliance with MWSt regulations is of utmost importance for businesses. Non-compliance can result in fines, penalties, and legal issues. Therefore, understanding and adhering to the reporting requirements related to MWSt is crucial for businesses to maintain their financial stability and reputation.

Businesses must keep accurate records of all MWSt transactions, including sales, purchases, and MWSt collected or paid. These records should be organized and readily available for auditing purposes. Depending on the country’s regulations, businesses may be required to file regular MWSt returns, which provide details of MWSt collected and paid during a specific reporting period.

It’s also essential for businesses to ensure they are charging and collecting the correct amount of MWSt from customers. This requires a clear understanding of the MWSt rates applicable to their goods or services, as well as any exemptions or reduced rates that may apply. Businesses should regularly review their MWSt calculations and seek professional advice if needed.

In addition to compliance with MWSt reporting requirements, businesses should also be aware of any changes or updates to MWSt regulations. Tax laws and regulations can evolve over time, and businesses need to stay informed to ensure ongoing compliance. Subscribing to relevant industry newsletters, attending seminars or webinars, and consulting with tax professionals can help businesses stay up to date with MWSt regulations.

Strategies For Managing MWSt Effectively

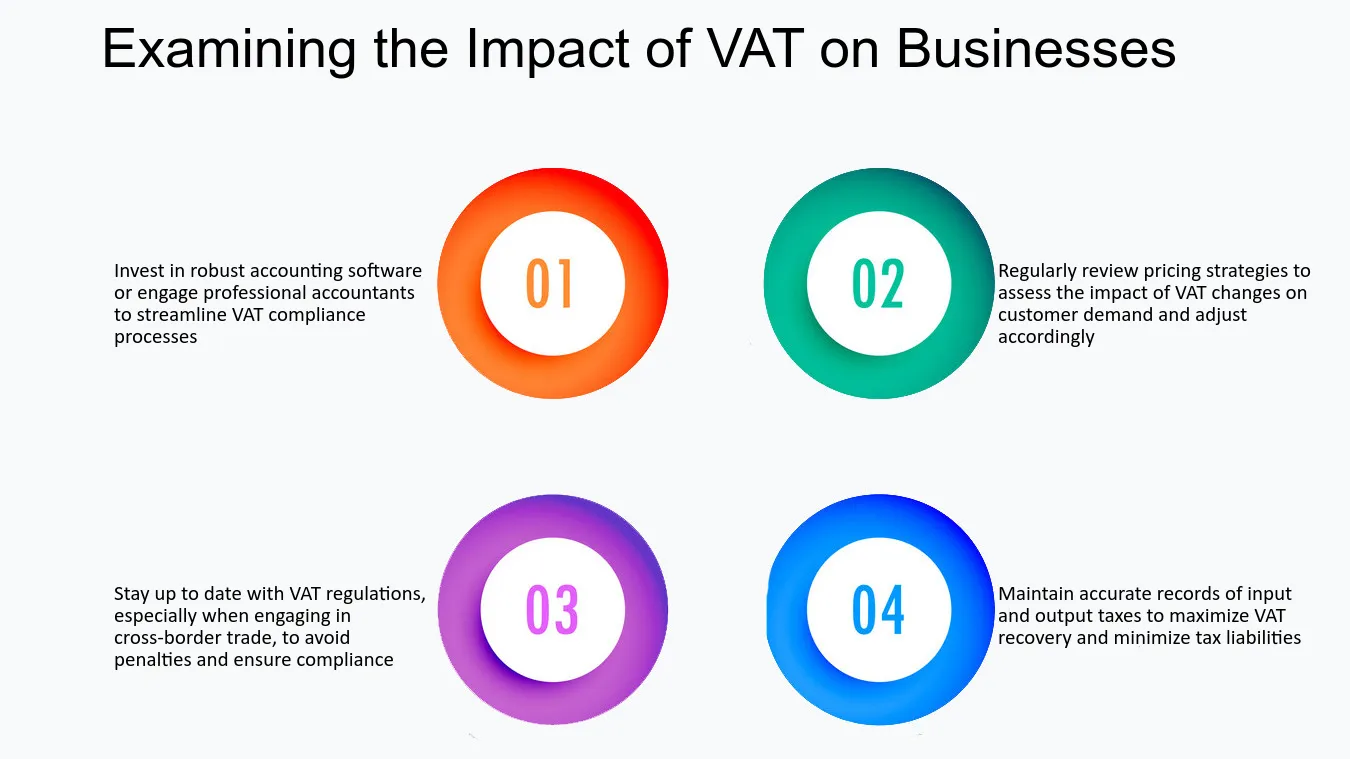

Managing MWSt effectively requires a strategic approach and careful consideration of the specific needs and circumstances of each business. Here are some strategies that can help businesses navigate the complexities of MWSt and optimize their financial performance:

Automate MWSt Calculations: Utilize accounting software that can automate MWSt calculations and streamline reporting processes. This reduces the risk of errors and saves time and effort.

Regularly Review Pricing Strategies: Continuously review pricing strategies to ensure they align with MWSt regulations and market conditions. Consider the impact of MWSt on profit margins and consumer behavior.

Invest In Training And Education: Provide training to employees responsible for MWSt calculations and reporting to ensure they have a clear understanding of the regulations and requirements. Stay updated with changes in MWSt laws through educational resources.

Engage With Tax Professionals: Consult with tax professionals who specialize in MWSt to ensure compliance and receive expert advice on specific MWSt issues. They can provide insights on optimizing MWSt management and identifying potential cost-saving opportunities.

Maintain Accurate Records: Keep detailed records of all MWSt transactions, including sales, purchases, and MWSt collected or paid. This ensures compliance and provides a clear audit trail if necessary.

Monitor Changes In MWSt Regulations: Stay informed about any changes or updates to MWSt regulations that may affect your business. Regularly review MWSt laws and seek professional advice to ensure ongoing compliance.

By implementing these strategies, businesses can effectively manage MWSt and mitigate potential risks and challenges. It’s important to remember that MWSt management is an ongoing process that requires continuous monitoring and adjustment.

Common Challenges Businesses Face With MWSt

While MWSt is an essential aspect of business finance, it can also present several challenges for businesses. Some of the common challenges include:

Complexity: MWSt regulations can be complex and vary by country. Understanding and interpreting these regulations can be challenging, especially for businesses operating in multiple jurisdictions.

Administrative Burden: Complying with MWSt reporting and documentation requirements can be time-consuming and resource-intensive. Businesses need to allocate sufficient resources to manage these administrative tasks effectively.

Cash Flow Impact: Collecting and remitting MWSt can impact cash flow, particularly for businesses with high MWSt liabilities. Adequate planning and budgeting are necessary to ensure sufficient funds are available to meet MWSt obligations.

Penalties And Fines: Non-compliance with MWSt regulations can result in fines, penalties, and legal issues. Businesses need to stay informed and ensure they are adhering to the specific requirements in their jurisdiction.

Cross-Border Transactions: Businesses involved in cross-border transactions may face additional MWSt challenges, such as determining the correct MWSt treatment and dealing with international MWSt regulations.

Keeping Up With Regulatory Changes: MWSt regulations are subject to change, and businesses need to stay informed and adapt their processes accordingly. Failure to keep up with regulatory changes can lead to non-compliance and financial consequences.

While these challenges can be daunting, businesses can overcome them by implementing effective MWSt management strategies, seeking professional advice when needed, and staying updated with MWSt regulations.

MWSt Optimization Techniques

Optimizing MWSt management can help businesses reduce costs, improve cash flow, and enhance overall financial performance. Here are some techniques businesses can consider to optimize their MWSt management:

Identify MWSt Exemptions And Reduced Rates: Determine if any exemptions or reduced MWSt rates apply to your goods or services. This can help reduce the overall MWSt liability and potentially make your offerings more attractive to customers.

Leverage MWSt Refunds: Explore opportunities to claim MWSt refunds on eligible business expenses. By understanding the MWSt refund process and maintaining accurate records, businesses can maximize their MWSt refunds and improve cash flow.

Implement MWSt Automation: Utilize accounting software or dedicated MWSt management tools to automate MWSt calculations, reporting, and compliance. Automation reduces the risk of errors and saves time and effort.

Regularly Review MWSt Processes: Conduct periodic reviews of your MWSt processes to ensure compliance and identify areas for improvement. This includes reviewing MWSt rates, exemptions, and reporting requirements.

Engage With Tax Professionals: Seek advice from tax professionals who specialize in MWSt to optimize your MWSt management strategies. They can provide insights on cost-saving opportunities and help navigate complex MWSt regulations.

By implementing these optimization techniques, businesses can effectively manage their MWSt obligations and enhance their financial performance.

Conclusion And Key Takeaways

MWSt is a significant factor that impacts businesses and their financial operations. From pricing and revenue to financial planning and compliance, MWSt plays a crucial role in shaping a company’s financial landscape.

To successfully manage the impact of MWSt, businesses must understand and adhere to the regulations in their jurisdiction. This includes accurately calculating and collecting MWSt, maintaining detailed records, and meeting reporting and compliance requirements.

By implementing strategies such as automating MWSt processes, regularly reviewing pricing strategies, and engaging with tax professionals, businesses can optimize their MWSt management and mitigate potential challenges.

Navigating the complexities of MWSt can be overwhelming, but with the right knowledge and strategies, businesses can effectively manage this crucial aspect of business finance and ensure their financial stability and success.

Key takeaways:

MWSt, or Value Added Tax, is a tax imposed on the sale of goods and services in many countries.

MWSt rates and exemptions vary by country, and businesses must understand the specific regulations in their jurisdiction.

MWSt has a direct impact on pricing and revenue, and businesses need to carefully consider its implications on their profit margins and consumer behavior.

MWSt plays a significant role in financial planning and budgeting, and businesses must accurately forecast MWSt revenues and plan for MWSt payments and refunds.

Compliance with MWSt regulations is crucial, and businesses must keep accurate records and adhere to reporting requirements to avoid penalties and legal issues.

Strategies for managing MWSt effectively include automating calculations, regularly reviewing pricing strategies, investing in training and education, engaging with tax professionals, and maintaining accurate records.

Common challenges businesses face with MWSt include complexity, administrative burden, cash flow impact, penalties and fines, cross-border transactions, and keeping up with regulatory changes.

Optimization techniques for MWSt management include identifying exemptions and reduced rates, leveraging MWSt refunds, implementing automation, regularly reviewing processes, and seeking professional advice.

By effectively managing MWSt, businesses can reduce costs, improve cash flow, and enhance overall financial performance.