Payroll professionals in Germany play a vital role in ensuring employees are paid accurately and on time, which is a critical aspect of managing any workforce. Given the complexity of German employment law, it’s essential for payroll staff to have a deep understanding of legal requirements, tax laws, and company-specific policies.

Beyond handling salary payments, payroll staff are responsible for a range of tasks that help companies stay compliant with labor regulations. Their expertise is key to keeping employees satisfied and preventing costly legal issues down the line.

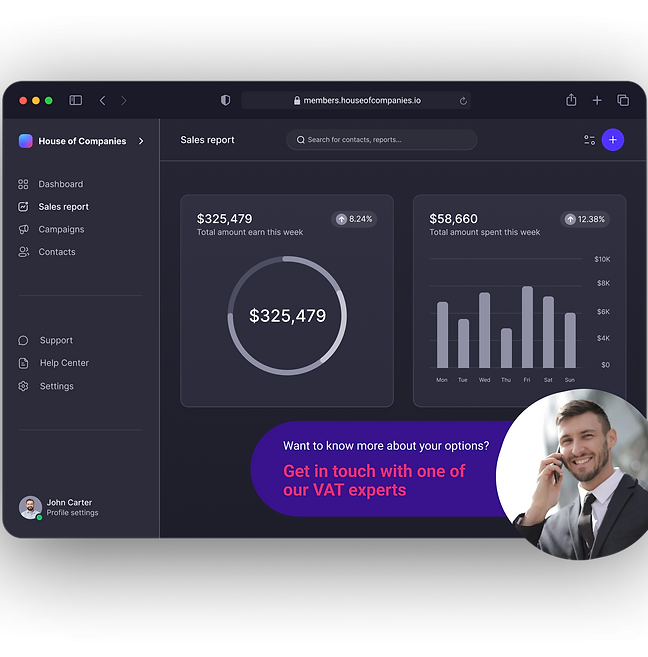

Discover how our Entity Management Portal serves as a one-stop solution for your market entry needs. This innovative platform simplifies your operations, enabling you to manage payroll, compliance, and HR functions with ease. With access to essential tools and resources, you can navigate the complexities of entering new markets confidently and efficiently.

Working in payroll in Germany requires a combination of technical knowledge, attention to detail, and strong communication skills. Some of the key qualifications and skills that payroll staff need include:

With our expert team by your side, you can navigate the complexities of payroll management with confidence. Let us help you streamline your operations and focus on what you do best—growing your business! Contact us today to learn more about our services.

“Partnering with Entity Management was a game-changer for our expansion into Germany. They handled everything seamlessly!”

Jane DCEO of Tech Innovators

Jane DCEO of Tech Innovators“The team’s knowledge of local regulations saved us time and headaches. Highly recommend their services!”

Mark RHR Manager at Global Retail

Mark RHR Manager at Global Retail“We felt supported every step of the way. Their personalized approach made all the difference.”

Lisa MFounder of Startup Solutions

Lisa MFounder of Startup Solutions

Outsourcing payroll can save you time, reduce errors, ensure compliance, and lower costs associated with hiring an in-house team.

Businesses must adhere to labor laws, minimum wage regulations, and tax contributions, ensuring employees receive accurate payslips.

Payroll is typically processed monthly, with salaries paid at the end of the month.

We handle a range of benefits, including health insurance, retirement plans, and paid leave, ensuring compliance with local laws.

Yes! Our EOR services allow you to hire remote employees while we handle compliance and payroll responsibilities.

We implement robust security measures to protect sensitive employee data, ensuring confidentiality and compliance with GDPR.

Our team assists with onboarding, including contract management, compliance checks, and benefits enrollment.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!