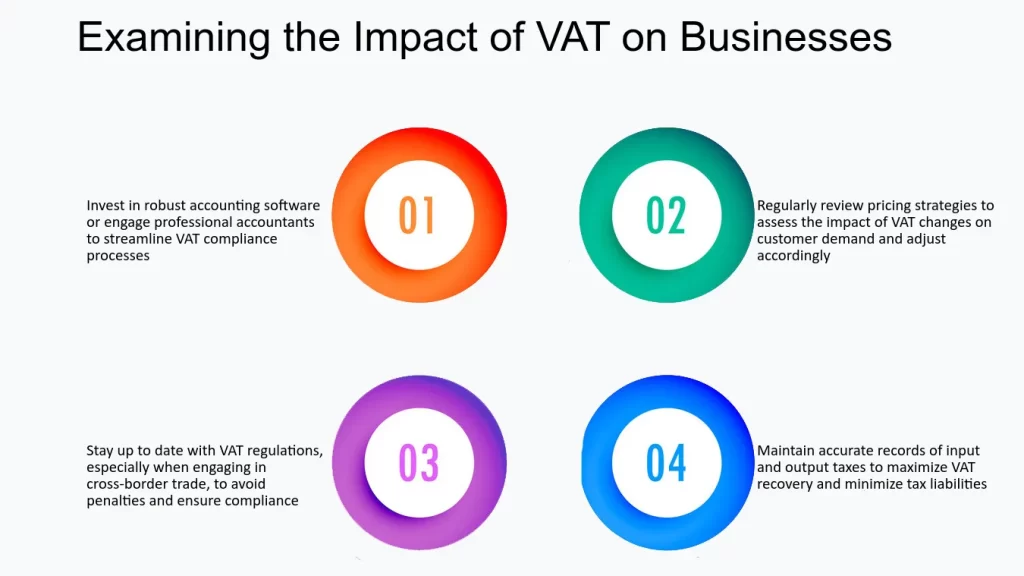

Our comprehensive global entity management services empower your business, whether you’re operating within the EU or expanding into non-EU markets. With a strong focus on Germany, we provide you with expert guidance to navigate local regulations seamlessly. Whether you’re entering new markets or restructuring your operations, we help you achieve full compliance, streamline your administrative tasks, and deliver customized support tailored to your unique business needs.

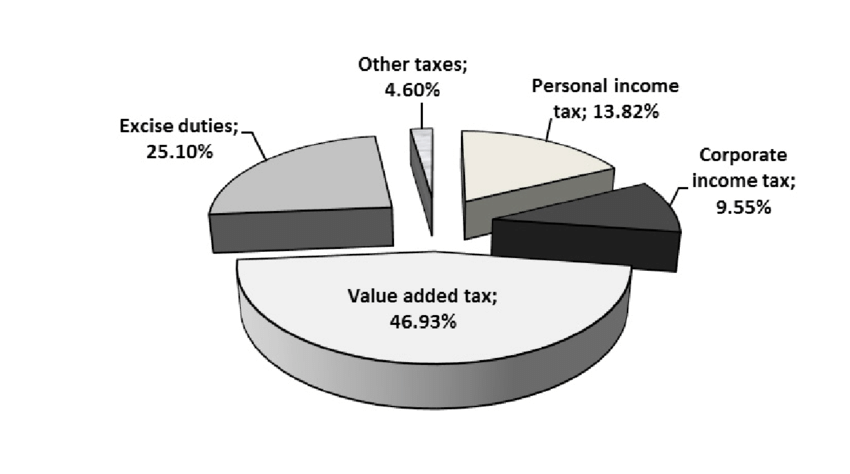

Experience stress-free VAT return submissions with our dedicated services. We specialize in assisting businesses globally, particularly focusing on VAT filings for non-EU countries, with Germany as our primary area of expertise. Our skilled tax professionals work diligently to ensure timely submissions, reduce errors, and enhance your VAT processes. Partner with us for reliable support tailored to your needs.

Our expertise in local regulations helps you save time and avoid costly penalties, so you can concentrate on what matters most—growing your business. Whether you need a one-time filing or continuous VAT management, we’re here to make the process seamless and stress-free for you.