It can be hard to file company tax returns in Germany, but it’s important for all businesses that do business there to follow the country’s tax rules. Our customized Entity Management services are made to make tax filing easy for companies all over the world, even those from non-EU countries that do business in Germany. We handle the entire process for you, ensuring your company stays compliant with all legal requirements while helping to optimize your tax situation.

Corporate tax (Körperschaftsteuer) is applied to the profits of companies based in Germany, as well as foreign companies operating within the country. The standard corporate tax rate in Germany is 15%. On top of this, there is a solidarity surcharge of 5.5% on the corporate tax, bringing the effective rate to 15.825%. In addition to corporate tax, companies are also required to pay a local trade tax (Gewerbesteuer), which differs based on where the business is located.

All companies registered in Germany, including

Corporate tax, or Körperschaftsteuer, is a tax that is put on the income of businesses in Germany, whether they are based there or are just doing business there. Deutschland’s normal rate of business tax is 15%. Plus, there is a 5.5% surcharge for solidarity on top of the company tax, which makes the real rate 15.825%. Companies have to pay both corporate tax and a city trade tax (Gewerbesteuer), which is different depending on where the company is located.

After preparing the financial statements, the next step is to calculate taxable income. This involves determining the total profits earned by the business, then subtracting deductible expenses like operating costs, depreciation, and other qualifying business expenses.

The corporate tax return needs to be completed and submitted online using Germany’s official tax filing portal, ELSTER. This form will outline the company’s income, applicable deductions, and the taxes due for the year.

In addition to filing their corporate tax return, companies are also required to submit a local trade tax return (Gewerbesteuererklärung). This tax is imposed by municipalities and the rate can differ depending on where the business is located.

Once the tax return is submitted, the tax authorities will review it and send an assessment notice. The company is then responsible for paying any remaining tax by the specified deadline.

“Expanding our business to Germany was a seamless experience thanks to their expert support. They guided us through everything, from registering the company to staying compliant, making the entire process smooth and efficient!”

Tech Startup FounderCEO

Tech Startup FounderCEO“Their international expertise was invaluable in helping us navigate Germany’s regulations and expand beyond. We wouldn’t have been able to reach non-EU markets without their support.”

International Trading FirmOwner

International Trading FirmOwner“Outsourcing our administrative tasks to them was a game-changer. They took care of everything, freeing us up to focus on growing our business.”

E-commerce Business OwnerCEO

E-commerce Business OwnerCEO

We help your business navigate Germany’s complex regulations, from tax filings to trade laws, ensuring full compliance. Our tailored solutions are designed to meet your specific needs, so you can focus on what matters most growing your business.

We offer comprehensive assistance for starting or growing your business in Germany. From company registration to securing residency permits and obtaining the necessary business licenses, we’re here to guide you every step of the way.

With extensive experience in managing international operations, we help businesses navigate compliance, taxation, and governance, with a special focus on Germany and markets outside the EU.

We handle all the administrative responsibilities, from corporate filings to bookkeeping, allowing you to focus on your business while ensuring everything stays on track and compliant with deadlines.

Opting for Entity Management Services helps your business stay compliant with Germany’s intricate regulatory requirements, streamlines administrative tasks, and offers expert advice for both domestic and global operations.

We assist businesses in understanding and complying with Germany’s corporate regulations by offering customized support for tax filings, reporting requirements, and trade laws. Our goal is to ensure that all obligations are fulfilled accurately and on time.

Our comprehensive market entry services guide you through every step, from registering your company to securing the required business licenses and handling residency permits, ensuring a smooth and efficient business setup.

We specialize in supporting businesses with their international operations, offering guidance on cross-border compliance, taxation, and corporate governance. Our expertise is particularly valuable for companies engaged in business activities outside the EU.

We take care of all the administrative responsibilities, including corporate filings and bookkeeping, so you can concentrate on what you do best. At the same time, we make sure everything stays in line with regulatory standards.

To get started, feel free to reach out to us to discuss your unique requirements. We’ll work with you to create a personalized service package that aligns with your business goals in Germany.

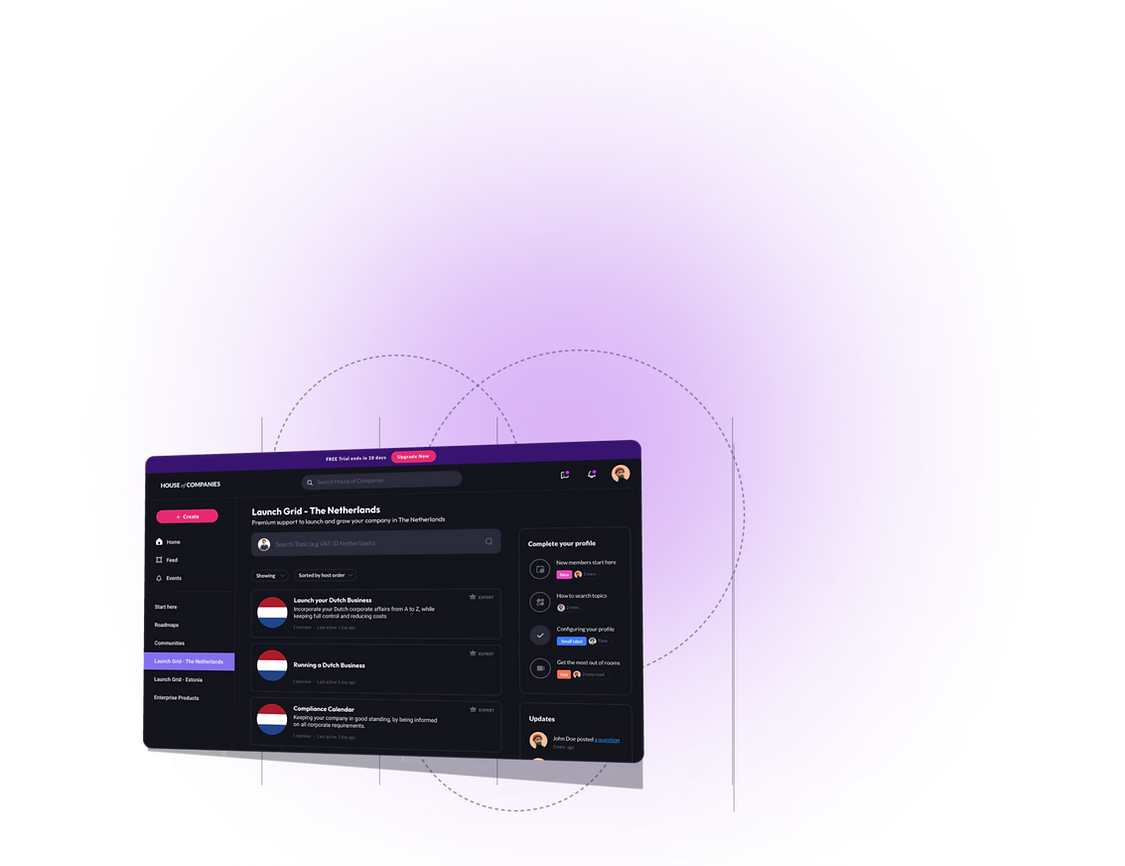

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!