If you’re expanding your business into Germany, navigating VAT reporting can feel like a daunting task. But with the right guidance and support, it doesn’t have to be! Whether you’re a local business or an international entity, staying compliant with Germany’s VAT rules is crucial to your success.

At our company, we take the complexity out of VAT reporting. We know that tax regulations can seem overwhelming, especially when operating in a new market. That’s why we’re here to guide you every step of the way—offering expert advice, easy-to-follow processes, and peace of mind. With our dedicated support, you can focus on growing your business while we handle the details.

German VAT law imposes strict rules on invoices, as they are crucial for both VAT reporting and claiming input tax deductions.

To be considered valid, invoices must include specific information, such as:

Businesses in Germany that are registered for VAT need to send in VAT returns on a frequent basis. The VAT paid on business costs (called “input tax”) and the VAT collected on sales are added up in these returns. How often these VAT returns need to be sent in varies on how much money the business makes.

Businesses with a VAT bill of more than €7,500 must file monthly reports. People can ask for a lifelong extension, which is called “Dauerfristverlängerung,” and that will let them file by the 10th of the next month.

Businesses with an annual VAT liability ranging from €1,000 to €7,500 are eligible to submit VAT returns on a quarterly basis. The deadline for filing these returns is the 10th day of the month following the end of the quarter.

If a company owes less than €1,000 in VAT each year, it only needs to file one VAT return each year. Usually, this return has to be turned in by July 31 of the next year.

A key idea in VAT reporting is the reverse charge mechanism, which is used a lot for activities that happen across borders. It usually means that the buyer, not the seller, has to report and pay VAT. A lot of business deals happen this way between companies in different EU countries and within the EU for certain goods and services.

Let’s say a German company buys things from a supplier in a different EU country. The seller won’t add VAT to the bill in this case. The German company must instead keep track of and pay the VAT as part of its VAT report. The company can then get this VAT back as input tax, which essentially cancels out its VAT debt.

The reverse charge method makes it easier to report VAT for trade across borders and lowers the risk of tax fraud. Businesses must make sure they follow this rule properly and include all the necessary information on invoices to stay in line with VAT rules.

Compliance with VAT reporting requirements is crucial for businesses operating in Germany. The German tax authorities take VAT compliance seriously, and failure to comply with VAT regulations can result in significant penalties.

Germany offers several special VAT schemes that businesses can use to simplify VAT reporting and reduce their administrative burden. These schemes are particularly beneficial for small businesses and businesses that engage in cross-border trade.

VAT (Value Added Tax) in Germany is a consumption tax applied to goods and services. The standard VAT rate is 19%, with a reduced rate of 7% on certain items like food and books.

Any business or individual making taxable sales in Germany may need to register for VAT. This includes foreign businesses selling goods or services to German customers.

You can register for VAT in Germany by applying through the German Tax Office (Finanzamt). Foreign companies need to appoint a local fiscal representative if they don’t have a presence in Germany.

VAT returns are typically filed on a monthly, quarterly, or annual basis, depending on the turnover of your business. The deadline is generally the 10th day of the month following the reporting period.

VAT returns should include details of total sales, the VAT collected, and VAT paid on purchases (input tax). The difference between VAT collected and input tax is what you owe or are entitled to claim as a refund.

VAT payments are made directly to the German Tax Office by bank transfer. The payment should accompany the VAT return submission by the filing deadline.

Yes, if your input tax (VAT paid on purchases) exceeds the VAT collected from sales, you can claim a refund from the German Tax Office.

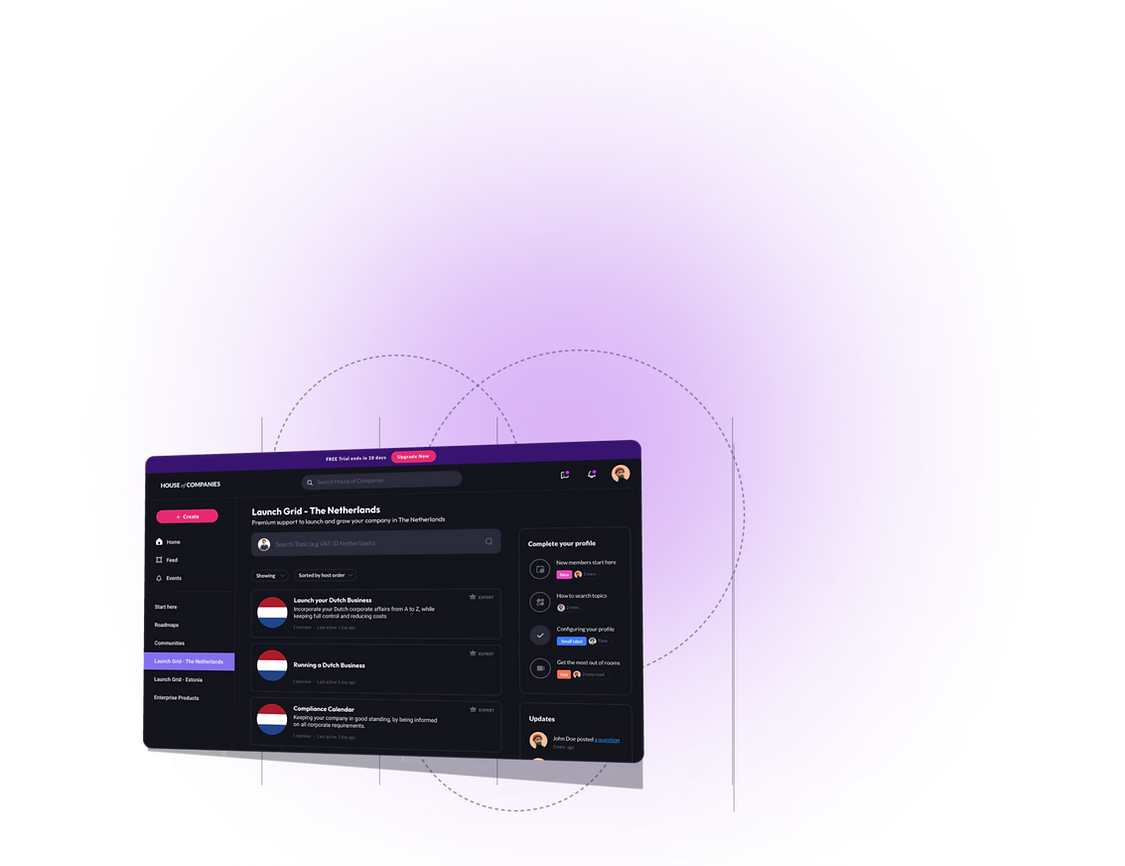

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!