Introduction

Are you curious about the advantages of implementing a value-added tax (VAT) system in Germany? Look no further. In this article, we will explore the numerous benefits that a VAT system can offer to the German economy.

Understanding The Current Tax System In Germany

Germany currently operates under a progressive income tax system, where individuals and businesses are taxed based on their income levels. While this system has its merits, there are certain limitations that can be addressed through the implementation of a value-added tax system.

One of the key issues with the current tax system is its heavy reliance on income tax as the primary source of government revenue. This puts a significant burden on high-income earners and can discourage investment and entrepreneurship. By introducing a VAT system, Germany can diversify its revenue streams and reduce its dependence on income tax, thereby creating a more balanced and sustainable tax structure.

Moreover, the current tax system in Germany is complex and entails high compliance costs for businesses. With multiple tax rates and various deductions, navigating the tax code can be a daunting task. Implementing a VAT system can simplify the tax administration process by streamlining tax rates and eliminating the need for complex calculations. This would not only reduce compliance costs for businesses but also improve overall tax efficiency.

Additionally, the current tax system may not effectively capture revenue from certain sectors of the economy, such as the informal or underground economy. This can lead to a loss of potential tax revenue and create an uneven playing field for businesses. A value-added tax system, on the other hand, can help address this issue by ensuring that taxes are collected at each stage of the supply chain, including those from informal or cash-based transactions.

Benefits Of Implementing A Value-Added Tax System

Boosting Economic Growth And Competitiveness

One of the primary benefits of implementing a value-added tax system in Germany is its potential to boost economic growth and enhance international competitiveness. Unlike income taxes, which can discourage saving and investment, VAT is a consumption-based tax that encourages individuals and businesses to spend and invest. By reducing the tax burden on exports, Germany can make its products more competitive in international markets, leading to increased exports and job creation.

Moreover, a VAT system can attract foreign investment by providing a stable and transparent tax environment. International investors are more likely to invest in countries with a well-established tax system that ensures fairness and predictability. By implementing a VAT system, Germany can send a positive signal to foreign investors and position itself as an attractive destination for investment.

Simplifying Tax Administration And Reducing Compliance Costs

Another significant advantage of a value-added tax system is its potential to simplify tax administration and reduce compliance costs for businesses. With a single tax rate applied at each stage of the supply chain, businesses can more easily calculate their tax liabilities and fulfill their tax obligations. This simplification can result in significant time and cost savings for businesses, allowing them to allocate resources towards productive activities rather than administrative tasks.

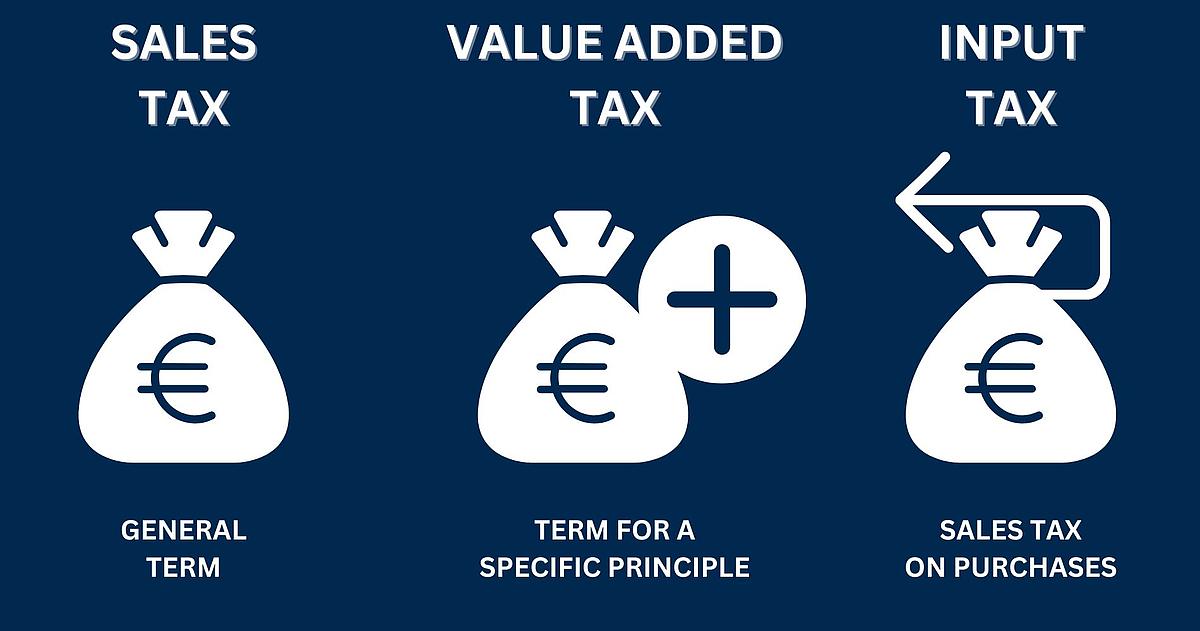

Furthermore, a VAT system can minimize the need for extensive record-keeping and documentation, as the tax liability is determined by the difference between input and output taxes. This reduces the administrative burden on businesses, particularly small and medium-sized enterprises (SMEs), who often struggle with compliance requirements. By reducing compliance costs, a VAT system can foster a more favorable business environment and encourage entrepreneurship and innovation.

Enhancing Tax Fairness And Reducing Tax Evasion

A value-added tax system is inherently based on the principle of fairness, as it is designed to ensure that the more you consume, the more you pay in taxes. This progressive nature of VAT can contribute to reducing income inequality and promoting a more equitable distribution of the tax burden. By shifting the focus from income to consumption, a VAT system can help redistribute wealth and ensure that everyone contributes their fair share to public finances.

Furthermore, a well-implemented VAT system can help combat tax evasion and increase overall tax compliance. VAT is a self-enforcing tax, as businesses have a direct interest in ensuring that their suppliers and customers are VAT compliant. This self-policing mechanism, combined with robust enforcement measures, can help minimize tax evasion and ensure a level playing field for businesses. By enhancing tax compliance, Germany can increase its tax revenues and allocate resources towards public services and infrastructure development.

Stimulating Investment And Innovation

Implementing a value-added tax system can stimulate investment and innovation in the German economy. By providing tax incentives for investment, such as reduced VAT rates on capital goods or machinery, Germany can encourage businesses to invest in modernizing their operations. This, in turn, can lead to increased productivity, job creation, and economic growth.

Moreover, a VAT system can promote innovation by incentivizing businesses to develop and adopt new technologies and processes. By reducing the tax burden on innovative products or services, Germany can create a favorable environment for research and development. This can drive technological advancements, improve competitiveness, and position Germany as a leader in the global marketplace.

Comparing Germany’s VAT System With Other Countries

When considering the implementation of a value-added tax system, it is essential to examine how Germany’s system would compare to those of other countries. While there is no one-size-fits-all approach, analyzing successful VAT models can provide valuable insights and best practices.

Countries such as France, Sweden, and Norway have successfully implemented VAT systems and have experienced positive outcomes. By studying their experiences, Germany can identify potential challenges and develop appropriate strategies to mitigate them. It is crucial to strike a balance between simplicity and effectiveness, ensuring that the VAT system is easy to administer while achieving its intended goals.

Challenges And Considerations In Implementing A Value-Added Tax System In Germany

Implementing a value-added tax system in Germany is not without its challenges. One of the key considerations is the potential impact on low-income households. VAT is a regressive tax, meaning it has a disproportionately higher impact on lower-income individuals who spend a larger proportion of their income on consumption. To address this issue, Germany can consider introducing progressive VAT rates or implementing measures to protect vulnerable groups.

Another challenge lies in transitioning from the current tax system to a VAT system. This requires careful planning and coordination to ensure a smooth transition without disrupting businesses or causing undue hardship to taxpayers. Germany can learn from the experiences of other countries that have successfully implemented VAT and develop a comprehensive roadmap for implementation.

Ensuring tax compliance and preventing tax evasion are ongoing challenges in any tax system, including VAT. Germany must invest in robust enforcement mechanisms, including effective auditing and monitoring systems, to minimize tax evasion and maintain a level playing field for businesses.

Conclusion

The implementation of a value-added tax system in Germany can bring about a wide range of benefits. From providing a reliable and sustainable revenue stream for the government to promoting fairness and equity in taxation, VAT can address many of the limitations of the current tax system. Furthermore, VAT can stimulate economic growth, simplify tax administration, enhance tax fairness, and encourage investment and innovation. While the implementation process may present challenges, careful planning and coordination can help Germany unlock the full potential of a value-added tax system and drive its economy towards a more prosperous future.